Solari European Video Server

“Caveat emptor (Let the buyer beware)” ~ The Ancient Rule

By Catherine Austin Fitts

This coming week we continue our publication of the 2018 Annual Wrap Up with the Equity Overview, including the new Rambus Blockbuster Chartology. Make sure to check out the financial charts on our 2018 Annual Wrap Up web presentation as well as the Chartology when it is posted on Thursday.

After a review of the performance and top stories of the financial markets in 2018, I will review our four scenarios developed for strategic planning in “2019: Get Ready, Get Ready, Get Ready.”

Next, I will cover the trends likely to impact investors over the next 12 months:

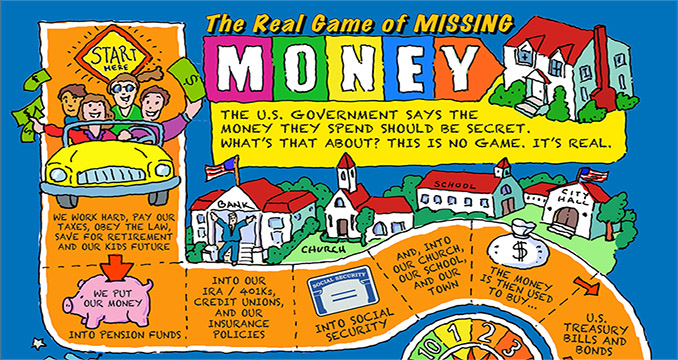

- Caveat Emptor: US Treasuries, US mortgage securities and defense contractors

- FASAB 56 & Green New Deal: Is piratization being engineered through obscure accounting and environmental policies?

- FASAB 56: Why we need to be concerned about mercenary armies

- Amazon: The Jedi Contract, the Divorce and the Play to Control A New Federal Systems Instructure

- Tech Divergence: The Shift from Global 2.0 to 3.0

- European Risks: Brexit, Italy and the Push for an EU Military

- Asian Risks: China Slowdown, Trade Wars and US Dollar Bear Trap

- National Security State: War Without End

- Covergence: Will Global Markets Equities Converge with the US?

- Musical Chairs: Risks in the Bond and Derivatives Market

- Peak Everything: Back to Basics

- IPOS: Tech & Space IPOS

- ESG: Authentic or Technocracy

- Bright Spots: Good Things Happening

In Let’s Go to the Movies, I will review Leonardo da Vinci: The Man Who Wanted to Know Everything and Leonardo da Vinci: “Dangerous Liaisions” from the BBC Series on Leonardo da Vinci. This year is the 500th-year anniversary of Leonardo da Vinci’s death, May 2, 1519. It’s an opportunity to partake of exhibitions and celebrations around the world celebrating this extraordinary artist and inventor. Learn all about it at this week’s Food for the Soul – lots of wondrous da Vinci eye candy!

https://youtube.com/watch?v=Rog5i2n1QVs

In Money & Markets this week I will discuss the latest in financial and geopolitical news. E-mail your questions for Ask Catherine or post at the Money & Markets commentary here.

Talk to you Thursday!