“Americans are not a perfect people, but we are called to a perfect mission.”

~ Andrew Jackson

By Catherine Austin Fitts

A state bullion depository provides a state and its residents with a secure, in-state location to store gold and silver. The goal is to improve financial resiliency in a manner that protects the sovereign powers of the state and its residents by providing or supporting:

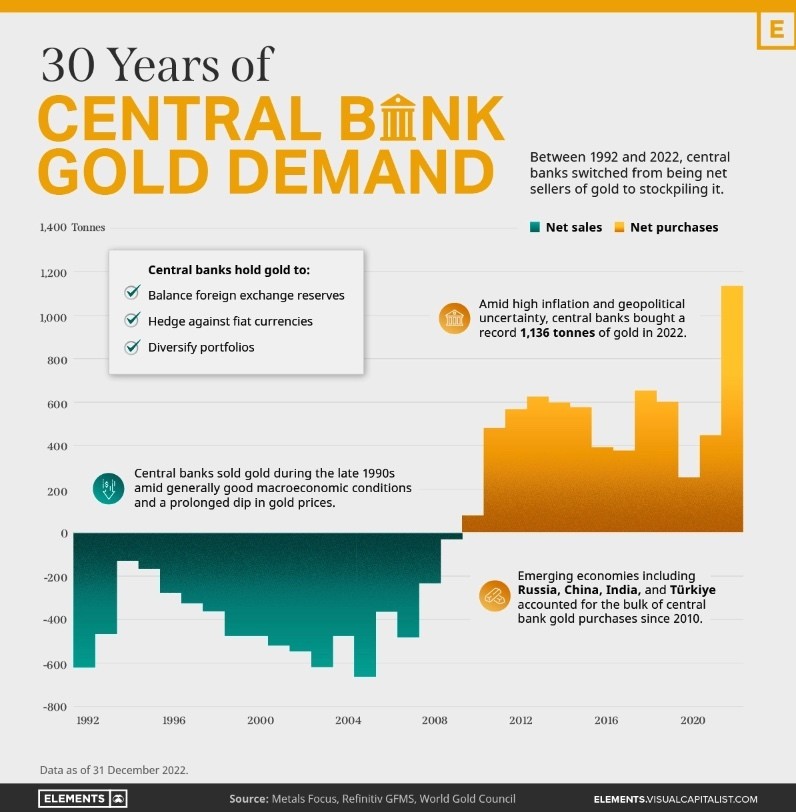

- A reliable way to own gold and silver as a hedge against deterioration of the global market share and/or inflation resulting from debasement of the U.S. dollar

- Transaction alternatives that protect against efforts to centralize control of financial transactions by banks and private parties outside of the state’s jurisdiction, including through such mechanisms as central bank digital currencies (CBDCs) and Fast Payment systems

- A secure in-state custodian that can make it easier for residents to use their gold and silver in daily transactions

The purpose of this paper is to address issues related to integrity of operations, including, importantly, those involving private parties. The goal of achieving such integrity is to ensure that the depository enhances, rather than compromises, state sovereignty and financial resiliency.

Related Reading:

The Solari Papers #3: Musings on the Department of Defense (June 2024)

The Solari Papers #4: Bitcoin Bailout: Why a Bitcoin Strategic Reserve Is a Bailout of the Big Boys (December 2024)

Financial Transaction Freedom: What is it, what threatens it, and how do I take action to secure it?

The Future of Financial Freedom

views: 198