The Global Landscape on Vaccine ID Passports Part 4: BLOCKCHAINED

By Corey Lynn of Corey’s Digs

Let’s get right to it because there’s a lot to cover. Part 3 tackled the key implementers of the digital identity being assembled through the vaccine ID passports, revealing the true agenda. Part 2 broke down the who, what, when, where, why, and how. It’s good to understand what’s at stake and who’s behind it, before diving into Part 4, which will cover some of the most important aspects of this entire agenda against all of humanity.

Part 4 details:

- The QR Code is About Your DATA, Your DNA, and Your BODY

- BLOCKCHAINED

- Wallets, Crypto, Central Bank Digital Currency (CBDC), and the Banks of the Future

- Artificial Intelligence and Augmented Humans

- Recap List of all Names and Organizations Covered in Parts 3 & 4

- Suggestions and Solutions

In brief, once you have submitted to getting your digital identity QR code, you have opened the door for them. Think of it like WordPress, which uses an endless amount of plugins to build your perfect site. Your smartphone is the device, the QR code is the tool, and all of the individual apps and institutions hook right into your QR code. You’ve now linked your health records, injection records, bank account, financial loans and assets, shopping, events, travel, you name it! They are using the blockchain framework to run, sync, share, and distribute all of that data under the guise of “convenience” for you. Some data will be centralized and some decentralized, but at the end of the day, your data are out there as a means for them to control you, remove all privacy, and be used for their AI agenda. This only happens if you take that first step. Whether it’s your bank requesting you create a digital ID, your state asking the same for a driver’s license, institutions calling for a “vaccine ID passport,” or whomever makes the request or demand, don’t open that door.

There is a list of solutions for how to combat this at the end of the report. Don’t miss it!

A quick peek at what the World Economic Forum predicts for the world in 2030:

Normalization of QR Codes to Access Your Data, Your DNA, and Your Body

A QR code is not just a flashy little symbol that gets you a free donut after accumulating points, or a convenient little app on your phone to prove you’ve received the Covid-19 injection that allows you access to a concert, or a quick way to make a purchase—though they want everyone to believe that’s the sole purpose. It is far more than that, and most people can’t even begin to understand the repercussions of its use and how they have weaponized it. This goes beyond the Covid injection data collection scheme for controlling humans across a smart grid and enters straight into the realm of eugenics.

Masahiro Hara from the Japanese company Denso Wave invented the QR code system in 1994. It was approved in December 2011 by GS1, an international standardization organization, as a standard for mobile phones, and by the International Standardization Organization (ISO) in 2020. Nowadays, everyone is seeing and utilizing the QR code, not only for vaccine ID passports, but for shopping, menus at restaurants, special programs at food chains, and just about everywhere. They’ve done a great job of normalizing a machine-readable visual symbol that contains data for identifiers, locations, tracking points, etc. The problem is that a QR code can only handle up to 7,089 characters, so in order to store a person’s entire life data, as the globalists wish to do, they need to link it through a blockchain platform.

Up until more recently, Internet Protocol Version 4 (IPv4) didn’t have enough Internet protocols (IPs) to accomplish this task, but with the new IPv6, there will be no shortage of IPs to make this all integrate effectively. This will allow for every single human, computer, cell phone, smart product, IoT sensor, and any other device that connects to the Internet to have a numerical IP address to communicate with other devices, accomplishing the globalists’ smart grid goal. Throw 5G into the mix, and we’re off to the races!

The application of “human barcode” and “microchipping” dystopian technologies to human beings has long been censored and dismissed by mainstream news as conspiracy theory, despite the fact that the science and products exist and, in some locations, have already been implemented. MIT has even published a study about it – funded by the Gates Foundation, of course. Even the Smithsonian couldn’t resist covering MIT’s study on how a “spiky patch” could invisibly record vaccination history under the skin, explaining that “the human body is an extraordinary record keeper.”

Here’s what’s interesting about this particular method: They liken this “tattoo-esque” technology of microneedles that inject patterns of invisible nanoparticles under the skin to QR codes that can be scanned by smartphones.

An NIH study from 2012 shows how investigators carried out research to determine the best way to identify and store DNA data; the study revealed that the QR code had the largest coding capacity and a high compression ratio, allowing the researchers to convert a DNA sequence to and from a QR code. They then constructed a web server for biologists to utilize QR codes in practical DNA barcoding applications. In 2021, the National Science Foundation raved about the next-generation sequencing technologies that have revolutionized genetic data, by allowing them to store the data in a QR code so they can simply scan a specimen and extract the data, which streamlines data collection.

What’s the next step? Now that they’ve managed to store DNA data into QR codes, putting that data onto a blockchain platform is the next best thing for scientists. Just imagine the millions of people who have submitted their DNA through Ancestry, 23andMe, and countless other eugenicist-owned organizations, such as George Church’s Nebula Genomics. Not that they are all putting the data on the blockchain yet, but Church and others certainly are. So where is this heading, and what is the QR code really about?

George Church

“Genomic big data is projected to outgrow video and text data within the next few years.” ~ Nebula Genomics

Molecular engineer, chemist, and geneticist George Church founded Nebula Genomics in 2018. The company runs whole genome sequencing that decodes 100% of a person’s DNA to “unlock [their] genetic blueprints.” For just $99–$299, you can “begin your journey of discovery without risking the privacy of your most personal information”—until Church rolls it onto the blockchain, that is. Nebula Genomics has partnered with Oasis Labs for “cutting-edge privacy technology” on blockchain. People will surely argue that blockchain is protected and none of these nefarious characters will have access to any of your data—but keep reading.

Why blockchain? What is their goal? Nebula wants to connect people with companies, and give people the opportunity to sell their genetic information—sequenced by Nebula—to these companies, in which case people will receive payment in the form of digital tokens, all in the name of science. This isn’t the only company Church owns or co-owns in regards to DNA collections going on the blockchain. More on this below.

Just how far will Church go to achieve being able to create whole genome engineering of human cell lines—to “write DNA and build human (and other) genomes from scratch?” In early 2021, there were warnings going out to all U.S. states regarding China trying to set up Covid testing labs in an attempt to gather DNA and other data on U.S. citizens. Even mainstream media couldn’t shy away from this story. The company, BGI and its U.S. subsidiary CGI, were approaching city, county, and state officials to sell their supplies and set up full labs. BGI was founded in 1999 as the Beijing Genomics Institute, had participated in the Human Genome Project that Church initiated, and was given a line of credit from state-run China Development Bank that it used to purchase 128 DNA sequencers from Illumina—a massive producer of DNA sequencers out of California. It was the largest order Illumina had ever received (more on Illumina further down). In 2017, BGI announced the launch of the George Church Institute of Regenesis, in collaboration with Church, who has been a longtime advisor to BGI. Church is the chief scientist of the Institute, which is co-located with the China National GeneBank in Shenzhen. Their plan, announced in 2017, over two years prior to Covid, was to develop technologies in high-density DNA storage, biomanufacturing of natural products, and genome editing for medicine.

In an appearance on the Stephen Colbert show, Church explained how his lab can read ancient DNA, write it, and edit it with CRISPR, and they’ve made 15 edits so far to bring back extinct DNA. For example, he’s been inserting woolly mammoth DNA into elephant skin cells, which can then be turned into stem cells and used to produce embryos with the hope of growing them in an artificial womb. “It’s going to be more humane and easier if we can set up hundreds of [embryos] in an incubator and run tests,” said Church.

This isn’t surprising, because in a 2013 interview with the German magazine Der Spiegel, Church said, “you have got a shot at anything where you have the DNA. The limit for finding DNA fragments is probably around a million years.” When asked about scientists’ possession of DNA fragments of Neanderthals, who existed 30,000 years ago, Church said that “the DNA could be assembled into an embryo which could be planted inside a human – a very daring woman.” He believes that significant knowledge could be gained from cloning Neanderthals, stating…

“We know that they had a larger cranial size. They could even be more intelligent than us. When the time comes to deal with an epidemic or getting off the planet or whatever, it’s conceivable that their way of thinking could be beneficial.”

Though Church acknowledged ethical and legal dilemmas, he was quick to point out that “laws can change.” Again, that interview took place in 2013.

Who is Dr. George M. Church, in a nutshell? The following barely scratches the surface:

- Professor of genetics at Harvard Medical School and Professor of Health Sciences and Technology at Harvard and MIT

- Founding Core Faculty & Lead, Synthetic Biology at Wyss Institute at Harvard University

- Director of the U.S. Department of Energy Technology Center

- Director of the National Institutes of Health Center of Excellence in Genomic Science

- Developer of the first direct genomic sequencing method and first genome sequence in 1984

- The “Godfather” of the Human Genome Project in 1984 and Personal Genome Project in 2005 (the U.S. National Academy of Sciences, NIH, and Department of Energy were all involved in the Human Genome Project, Congress kicked in $2.7 billion to make it happen, and it was made public in 2003)

- Co-author of over 550 publications

- Holder of more than 150 patents

- Co-authored the book Regenesis: How Synthetic Biology Will Reinvent Nature and Ourselves

- Funded by the Jeffrey Epstein VI Foundation from 2005–2007

- Founder of Nebula Genomics in 2018

- Co-founder of Veritas Genetics, Editas Medicine, Cambrian Genomics, LS9 (which sold to Renewable Energy Group in 2013), eGenesis, 64x Bio, Gen9, and several other companies

- Led project on barcoding the brain, via a $21 million, five-year brain mapping grant under the Machine Intelligence from Cortical Networks program sponsored by the Intelligence Advanced Research Projects Activity—their goal was to give neurons unique barcodes, linking them across synapses to create maps of their connection through gene sequencing to design computer architectures that could perform tasks that are easy for a brain but out of reach for artificial intelligence

- In 2008, Church, Bill Gates, and Leena Peltonen from the Wellcome Trust Sanger Institute all spoke at a genome sciences symposium at the University of Washington. In 2013, George Church was invited to speak at the Wellcome Trust Epigenomics of Common Diseases conference. In 2019, he was the keynote speaker for another Wellcome Trust event on new technologies. At this event, Church got a chuckle while referring to the image below as his “conflict of interest slide,” and his “thank you slide for organizations that help get our technology out into the real world.”

- In 2021, Church co-founded HLTH.network (formerly Shivom), a health care blockchain that created the world’s first global marketplace for genomic and health care data, operating with the OMX token. According to their site, HLTH.network is the “world’s first” precision medicine data hub, DNA NFT marketplace, crypto health store, healthcare blockchain focussed journal, and Avalanche focussed healthcare blockchain ecosystem fund—that’s a lot of firsts. Their mission is to provide the world with a tokenized and inclusive ecosystem that empowers all stakeholders to build a new era of healthcare—”one token for all healthcare blockchain for years to come.”

In order to further normalize gene editing, QR scans of DNA on the blockchain, and transhumanism, in true Hollywood fashion they’ve decided to make a “dramatic series on the dangerous and life-affirming ways the technology can impact the world.” Morgan Freeman and Lori McCreary of Revelations Entertainment, and Jay Firestone of Prodigy Pictures are partnering with George Church. They refer to him as a geneticist and CRISPR pioneer and state that the series will explore “personal and global implications of cutting-edge gene editing and engineering technologies being used in the effort to combat climate change,” and assure everyone that the impact this genetic technology will have on our lives is coming faster than we think. This was just announced in March 2021, so a release date hasn’t been publicized yet.

This is why George Church is such a significant player in their future agendas. By utilizing DNA, synthetic biology, QR codes, blockchain, and gene editing, he is paving the wave toward their vision of a transhumanism AI future—and who knows, he may just bring back dinosaurs one day. More on augmented humans and AI further down.

There are roughly 20 billion connected devices today, and with 5G, it is anticipated there will be 50 billion devices connected by 2030, with machines talking to machines. In a video of less than five minutes, the World Economic Forum reveals what they foresee for everyone’s future.

How badly do the powers-that-be want everyone plugged into the “smart grid”? In June 2021, Senator Patty Murray introduced a bill called the Digital Equity Act of 2021, and then stuffed it into the big Infrastructure Investment and Jobs Act that the Senate passed later in the year, with a proposed $2.75 billion in funding. This entire bill is about the “smart grid” infrastructure. The Act would require the National Telecommunications and Information Administration to establish a “State Digital Equity Capacity Grant Program” and the “Digital Equity Competitive Grant Program” to use your taxpayer dollars to ensure that every American has access to broadband and is plugged into the internet. They’ve created a website for “Digital Equity” as well.

It sounds like a wonderful convenience on the surface, unless you understand the grand plan. The stated purpose of these grants is to promote the achievement of digital equity, support digital inclusion activities, and build capacity. This promotion is to be delivered in lockstep, with every department rolling out the same message, such as Agriculture, Housing and Urban Development, Education, Labor, Health and Human Services, Veterans Affairs, the Federal Trade Commission, the Small Business Administration, and half a dozen others. States will each develop their “State Digital Equity Plan” in collaboration with “stakeholders” to achieve the digital inclusion activities and objectives, and they can make sub-grants to those stakeholders.

In July 2021, the National Security Commission on AI organized a Global Emerging Technology Summit. Among the multitude of topics discussed was the fact that the Organisation for Economic Co-operation and Development (OECD) set the standards for broadband and telecommunications infrastructure, “including the development of transparency reporting frameworks for terrorists and violent extremist content online,” in the 5G network rollout.

In simpler terms, what the “Digital Equity Act” is really about is building the framework to plug everyone into the “smart grid,” while states provide “digital inclusion activities” with statewide instructions on how people must link into their services—such as disability aid, social services, unemployment, digital ID, housing, and so on—while being surveilled through the new standards set with broadband and the 5G rollout.

The QR code was never about a free doughnut or an easier way for people to shop or market products—those were just stories put forth to normalize its use and play it off as a “convenience,” just like handy smartphones. The reality is that it’s about controlling the human race by aggregating all data on every human being and object, while enabling full surveillance over your life, and giving scientists full access into your body. So the next time a restaurant provides a QR code to access their menu, demand an actual menu or leave the restaurant. Stop using the QR codes everywhere you go. Stop swiping your smartphone and playing right into their hand. REFUSE QR CODES.

BLOCKCHAINED

“It’s possible that blockchain could end up being the single, secure token element to certify the authenticity of everything.” ~ Chad Ballard, Managing Director, Head of Core Banking Technology at JPMorgan Chase & Co.

The name of the game is to get all human beings and every product onto the blockchain for full traceability, where privacy will no longer exist. Think of the QR code as the middle man and the smartphone as the tool.

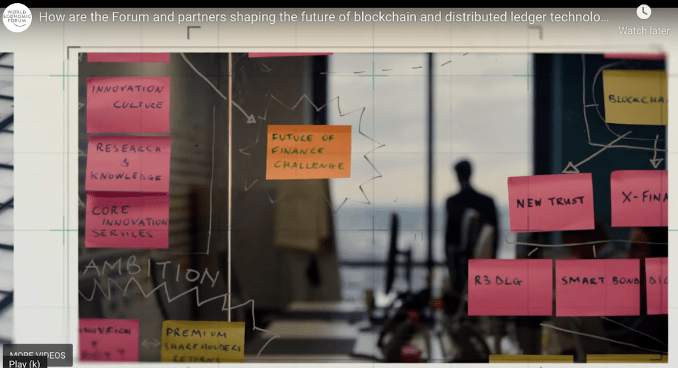

Blockchain technology can be a bit confusing, so here are some basics on how blockchain and tokenization work. Originally created for digital currency transactions, blockchain is now being used for IoT, supply chain tracking, financial services, asset management, identity verification, “smart contracts,” and much more. The “distributed ledger” blockchain framework allows for the collection of data that are shared and synchronized across multiple sites, countries, or institutions.

Most people are familiar with Bitcoin operating on a “decentralized” blockchain. (But don’t worry—as covered in Part 3, the Linux Foundation is covering the “privacy” end of things for all of these new blockchain platforms.) However, the programs and agendas being developed and carried out for full control over humanity involve not just “decentralized” systems but also systems that are “federated” and/or “centralized.”. There is an excellent chart that breaks this down on page 13 of the World Economic Forum’s 2019 report on “Trustworthy Verification of Digital Identities.” Nearly all of the “systems” being put in place involve utilizing the blockchain framework and distributed ledger technology for governance. Their intention is to create global regulations, laws, and interoperability. No matter how anyone spins the language to make it appear as though this is a secure system with privacy for all, those in power will have access to much of the data, and those data/records will never go away—they are permanent.

On page 6 of another report in this series outlining WEF’s “Framework for Blockchain Interoperability,” WEF explains that it expects an entire ecosystem of applications working with a handful of blockchain platforms because “the time is not yet right for convergence a single platform due to…commercial sensitivities, distinct views on technology choices, [and] different perspectives on governance” of blockchain networks.

The ultimate goal is to have every human being and every product traced, tracked, and surveilled. For example, the EVRYTHNG Product Cloud gives products a digital identity, creating a twin in the cloud, which is linked to an identifier that is embedded into the smart packaging or smart code, making the object interactive with software intelligence that allows it to participate in new applications. EVRYTHNG provides an API gateway called the Blockchain Integration Hub, which enables the data to be replicated or collected from different blockchains. In addition to supply chain history and live tracking data, it also hosts product metadata that need to be updated, such as data about temperature, humidity, or current owner. One can imagine the level of surveillance once all products are tied into the smart grid. Already, there are cities outfitted with street lights that host cameras everywhere people walk, under the guise of “protecting” everyone from crime or monitoring “climate change.”

The WEF’s 2020 Framework for Blockchain Interoperability talks about the advancement of Fourth Industrial Revolution technologies and how blockchain will allow for future supply chain transactions and business processes to be handled by autonomous software agents and IoT.

A short 3-minute video by the WEF titled “Shaping the Future of Technology Governance: Blockchain and Digital Assets” explains how blockchain is already here, touts the great ways it can be used, and assures everyone that “it’s not really important that you understand how blockchain works.” WEF is working with over 100 companies and eight governments on projects.

“Blockchain will fundamentally change financial systems in the next 10 to 15 years. A blockchain technology will be applied in many areas because it is about trust, credit, security – the security of data and the privacy of data.” ~ Jack Ma, cofounder of Ant Group and founder of Alibaba

J.P. Morgan envisions a world where “multiple blockchain networks of multiple protocols” will be “meshed together” due to the rapid evolution of technologies. They do not see a one-blockchain-network world—at least not yet. They themselves recently helped develop technology for the Monetary Authority of Singapore and the Central Bank of Canada to execute cross-currency through a cross-blockchain swap using Hash Time Locked Contracts (HTLC). They are working on a gateway layer that will make it easier to interact with multiple blockchains, and are excited about digital identities, green energy registration and trading, vehicle identity and telematics—all being enabled by blockchain technology for a “multi-blockchain world.”

Accenture, part of the ID2020 group discussed in Part 3, has a lot to say about how blockchain revolutionizes identity management, gives individuals the power to be back in control of their identities, and assures you that you get to decide what identity attributes you share with each organization.

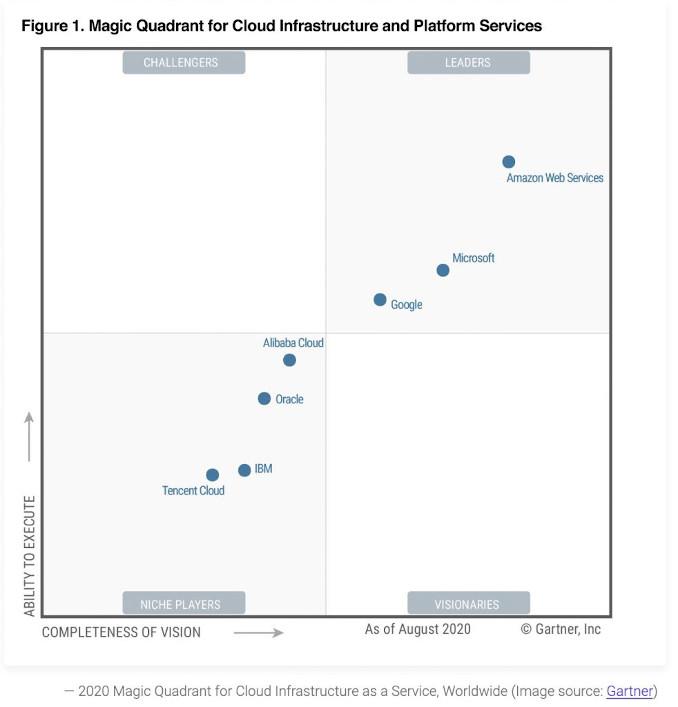

Cloud storage plays a significant role as well. This article compares Amazon’s AWS and Microsoft’s Azure. The chart below shows the current competition in this arena.

According to the charts from the WEF’s 2020 “Framework for Blockchain Interoperability” report, none of the large technology vendors that support blockchain have launched interoperability solutions except for Microsoft, which is currently working with Nasdaq on a project to create a ledger-agnostic solution. Other large technology firms include IBM, SAP, and Oracle. IBM utilizes Hyperledger Fabric for supported blockchains and IBM MQ for z/OS for hybrid cloud transformation for interoperability with non-blockchain. SAP uses Hyperledger Fabric, MultiChain, and Quorum for supported blockchains and integrates SAP solutions to blockchains via a SAP cloud service and blockchain adapter for interoperability with non-blockchain. Oracle also utilizes Hyperledger Fabric for supported blockchains and REST APIs and Hyperledger SDKs for interoperability with non-blockchain.

The WEF report also includes a chart indicating documented technologies being used for individual blockchain or interoperability solutions. Those are:

AION

ARK

Bitcoin

BTC Relay

Corda

Cosmos

Ethereum

Hyperledger

Hyperledger Quilt

ICON

Interledger

POA

Polkadot

r3 Corda Settler

Ripple

Wanchain

And finally, the report discusses some of the bigger organizations that are focusing on creating standards to drive business model interoperability. Those are:

Belt and Road Initiative Blockchain Alliance

Blockchain Industrial Alliance

Blockchain in Transport Alliance

British Standards Institution

China Electronic Standardization Institute

Digital Container Shipping Association

Enterprise Ethereum Alliance

European Blockchain Partnership

GS1

Institute of Electrical and Electronics Engineers

International Organization for Standardization

Mobility Open Blockchain Initiative (MOBI)

In addition to this, according to a discussion paper on geospatial standardization of distributed ledger technologies by the Open Geospatial Consortium (OGC), there are several groups working on blockchain standardization:

FOAM initiative

International Federation of Surveyors (FIG)

International Organization for Standardization (ISO)

International Telecommunication Union (ITU-T)

World Bank

Big Moves in Blockchain Already Underway

Below are examples of how the blockchain framework is being used to track, trace, and surveil products and people.

- China launched a major blockchain initiative called the Blockchain-based Services Network (BSN) that created an infrastructure for interconnectivity throughout the mainland, including city governments, companies, individuals, and the Digital Silk Road to connect with China’s trade partners around the globe. The main founding partners are the State Information Center, China Mobile, China Unionpay, and Red Date Technologies. BSN has developed cloud management technology to allow multiplexing compute with cloud providers under BSN’s multi-cloud services already in place, such as Amazon’s AWS, Microsoft Azure, Google Cloud, Baidu Cloud, China Unicom, China Telecom, and China Mobile. They have a massive rollout in place to connect all major cities in the country. Their goal is to utilize the blockchain technology as infrastructure for smart cities, data, currency, and of course link databases by 5G.

BSN is a permissioned chain forked from Hyperledger Fabric, allowing interoperability with major blockchain platforms and frameworks such as Hyperledger Fabric, Ethereum, and EOS, in addition to WeBank’s FISCO BCOS with members of WeBank, Tencent, Huawei, and ZTE.

According to the Wall Street Journal, China is pitching BSN as a digital infrastructure for developers worldwide with server space at only a few hundred dollars annually, programming tools to create blockchains, and templates. They say that success could put China in a powerful position to influence future development of the Internet itself, while promoting international use of a homegrown Global Positioning System and a digitized national currency.

- MOBI is a nonprofit alliance with an extensive partner list, including some of the world’s largest vehicle manufacturers, governments, NGOs, transit agencies, insurers, and blockchain and tech companies, such as Accenture, Amazon, European Commission, Ford, GM, Honda, Hyundai, IBM, Hyperledger, Ripple, Sovrin, Texas A&M Transportation Institute, WEF, and over 40 others. These partners have teamed up to create blockchain-based standards to identify vehicles, people, businesses, and trusted trips so as to make transportation more efficient, affordable, greener, safer, and less congested, with a focus on autonomous vehicles as well.

Speaking of the automotive industry, the HERE platform provides customizable location data with the industry’s largest location datasets in over 200 countries and territories. Funded by Audi, BMW, Bosch, Continental, Mercedes, Intel, Mitsubishi, NTT, and Pioneer, they produce instruction sets for a car or robot and spatial intelligence to manage roadworks, plan a 5G network, or develop mapping applications. Partners include Amazon AWS, Esri, Microsoft, Oracle, SAP, Verizon, Siemens, and others. The HERE platform will surely be integrated for digital identity with autonomous driving services.

- Illinois has its own consortium of state and county agencies under the Illinois Blockchain initiative, which is working with the Department of Innovation & Technology (DoIT) to create hyperconnected services for a highly “efficient” government, a digital identity, and other things. A task force was created back in 2018. One county is using blockchain to register land titles. Interestingly, it seems many countries are using blockchain for land title registries.

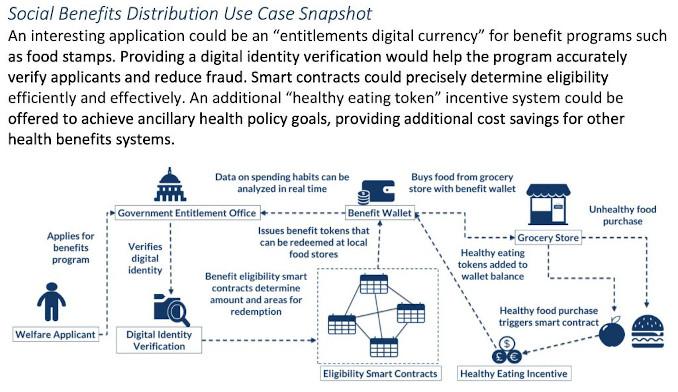

Below is a snapshot of Illinois’ plans for digital currency, digital ID, entitlements, smart contracts, and “healthy eating tokens.” They have several other charts in their strategy document, which includes drones and other fun stuff.

- NASA is in the process of utilizing blockchain and smart contracts for some of its projects, one being its SensorWeb program, which creates an interoperable environment of Earth-observing satellite sensors.

- Chemonics International, a big USAID contractor, won an award in 2018 for its development of the blockchain for Biodatas Solution, which it developed with BanQu. This platform changes the entire USAID contracting mechanism by eliminating the need to collect, verify, and store personnel information, while expediting the process. As a reminder, in 2015 USAID awarded Chemonics a $9.5 billion eight-year IDIQ contract to fund health supply chain programs to prevent HIV/AIDS, malaria, and tuberculosis, making it the largest USAID contract awarded to date. Chemonics was only able to get 7% of the shipments delivered on time and in full. To date, it’s a bit of a mystery as to where all the drugs went, as well as the $9.5 billion. Nonetheless, just three years later, the Gates Foundation granted $386,680 to Chemonics to “monitor the temperature of critical health products along the global health supply chain to ensure the quality and efficacy of these life-saving products,” essentially making an award for the same job Chemonics had already epically failed at.

- Visa has applied for 159 blockchain-related patents that involve making transactions more secure and using biometrics to verify someone’s identity. In 2020, Visa filed a patent to create a blockchain-based digital currency with the goal of replacing cash. The company has indicated it wishes to act as a central entity computer that creates a digital currency using a serial number and denomination of physical currency. This patent would apply to all digital currencies: Ethereum, CBDCs, pounds, yen, and euros. Last year, Visa partnered with Ethereum to connect its payment network of 60 million merchants to the U.S. Dollar Coin (USDC) developed by Circle Internet Financial. Entrust, a partner of The Good Health Pass, recently contracted by the UK to produce digital Covid certificates, announced its Visa Ready certified partnership and Visa Fintech Partnership in June 2021. Entrust was covered in Part 3 of this report. In July, Binance, the world’s largest cryptocurrency exchange with a $2 trillion trading volume last year, rolled out a Visa debit card that automatically converts users’ crypto assets to local currency.

- In 2018, Oracle launched its blockchain-based Global Shipping Business Network, a maritime shipping consortium that includes container-shipping giants and port operators.

- Louisiana is ahead of the game and has already created the “LA Wallet,” which utilizes a QR code to pull up driver’s license information that replaces an actual plastic driver’s license. The state is now integrating Covid injection smart health cards.

- Hyperledger is an umbrella project of open source blockchains and other related tools launched in 2015 by the Linux Foundation. It has received funding from IBM, Intel, and SAP Ariba. Hyperledger Fabric is a collaboration between the Linux Foundation and over 80 financial and technological companies including IBM, DTCC, JPMorgan Chase, Accenture, and Cisco.

- India has added 300 million bank accounts in just three years, with government-managed online standards in online payments and digital identity. India has also partnered with Accenture and BetterPlace Safety Solutions to create “Safedrive” for female employees, which shares a driver’s photo and data in advance of pick-up, with blockchain authenticating with the driver’s background data—all done through smartphones, of course.

- Ghana will become the first country to use contactless biometrics for its national vaccination program, beginning in October. The Ghana Health Service is partnering with Bill Gates’ Gavi to track the administering of vaccines, including Covid-19 injections, using biometrics created with Simprints technology with support from Cisco. Ghana is also working on integrating the biometrics into universal health coverage.

- Nigeria also has a biometrics scheme rolling out, with 60 million digital identities already linked to SIM cards, and a deadline of October 31, 2021 to get everyone on board. In addition, UGS Technologies, an enrollment partner, sealed a deal to register the biometrics of Nigerians living in the UK and in six other European countries for the National Identification Number (NIN) system.

- Boeing’s HorizonX venture arm is helping to fund the development of SkyGrid, a blockchain-enabled air traffic control system that tracks and communicates with drones. It’s been approved by the FAA to provide drone pilots with authorization, creating a permanent record of data. They believe it is important for package delivery, industrial inspections, and the future of autonomous flying taxis.

- Cargill partnered with Archer Daniels Midland (ADM), Bunge, COFCO, Louis Dreyfus Company, and Glencore Agriculture, in the Covantis platform, using Ethereum-based Quorum blockchain to create tracking records on moving grain and oilseed cargoes around the world.

Walmart is running a pilot program with U.S. Customs and Border Protection to track imported foods via blockchain.

Additional Information

The World Bank Group published a report titled Distributed Ledger Technology (DLT) and Blockchain in 2017. It gives a good breakdown of what a DLT is, how it works, how it relates to digital currencies, applications of DLT, smart contracts, and how the World Bank intends to leverage it. This was a collaboration between the Linux Foundation and over 80 financial and technological companies including IBM, DTCC, JPMorgan Chase, Accenture, and Cisco.

A report by the UK Government Office for Science, titled Distributed Ledger Technology: Beyond Block Chain, explores how distributed ledger technology can revolutionize services in government and the private sector.

Wallets, Cryptocurrency, Central Bank Digital Currency (CBDC), and Banks of the Future

“We’re on the cusp of another breakthrough innovation, including the poorest, in a financial system that increases instead of limiting the value of their assets. Transforming the underlined economics and financial services through digital currency will help those who live in poverty directly.” ~ Bill Gates

Plain and simple: they are using the pandemic and BlackRock’s “Going Direct” financial takeover to manipulate minds and manufacture industries. Their goal is to get everyone on broadband, carrying a smartphone, plugged into the grid with their QR digital ID, and onto blockchain platforms. The financial aspect of this is important to understand so that people can fight it every step of the way. John Titus of The Solari Report put together an indisputable parallel timeline of key economic events between “Going Direct” and Covid, which, by itself, reveals the globalists plotting to intentionally crash markets and bring people to their knees while making off with trillions.

In 2019, the Federal Reserve Bank of Kansas City published an article regarding QR code-based mobile payments in Japan, Singapore, and Hong Kong. Using those for study and comparison, part of the assessment concluded that QR code-based mobile payments substituting for cash will allow banks to reduce costs related to cash services and “increase the volume of consumer transaction data available to banks and nonbanks” to “better understand…customers’ behaviors and needs. While describing the QR code as a “speedier, safer, and more convenient” option than other digital payment options, the authors expressed concern about “fragmentation” with multiple wallets, stating that industry consolidation will help resolve such issues.

According to the OECD, digital wallets are among the fastest growing technology markets. Asia already has a billion users through payment apps that also integrate eCommerce, chat, deliveries, food ordering, and ride hailing. Nonbanks (such as PayPal, Apple, Google, Revolut, N26, and TransferWise) are also making an impact.

In 2020, the Federal Reserve Bank of Atlanta produced a paper titled “Shifting the Focus: Digital Payments and the Path to Financial Inclusion,” again trotting out the “financial inclusion” nonsense. Discussing the “benefits and consequences” of preserving cash as a payment option, they stated, “facilitating the continued use of cash may hurt consumers who may not otherwise be motivated to go digital, all else being equal. We may be perpetuating the use of a less efficient payment method, with both businesses and consumers suffering in the end.” HAAAA! Sorry, not to break up a serious report, but this is a bold-faced lie. Has anyone ever been hurt by cash, or suffered from having it? Think of the sheer manipulation in these twisted words.

The Atlanta Fed authors also point out the fact that there is no federal law in the U.S. that mandates cash acceptance, but that a handful of cities and states have passed legislation that bans businesses from refusing to accept cash. Surprisingly, they are Massachusetts, New Jersey, Pennsylvania, San Francisco, Philadelphia, Washington DC, and New York. Perhaps the newly introduced Payment Choice Act of 2021 will make it through legislation and protect consumers across the country from businesses rejecting their cash payments.

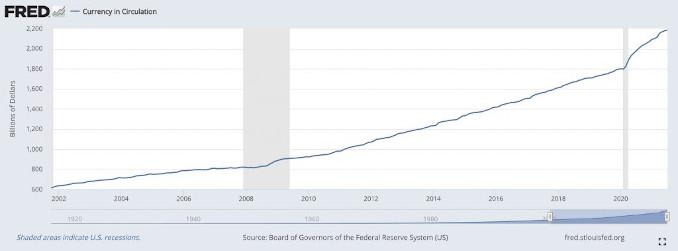

Despite the trickery and deceptive tactics, use of cash is actually on the rise. Central bankers want everyone to believe that people are using cash less and less and that everyone wants a bank account linked to digital currency, but the reality is that people don’t trust the banks and haven’t for a very long time. Moreover, the majority of those in developing countries without bank accounts do not want them. All of this is being pushed through under the guise of assisting “poor people” and helping with “climate change” and “the economy,” buttressed by the claim that everyone wants a “digital world.” It’s all nonsense.

This chart reflects the rise of currency in circulation. This is very important. People need to continue this trend and continue to use cash as often as possible. Using cash prevents the tracking of where you are spending your money, which is the REAL reason why technocrats want to go digital—so they can control it. Why give any of them swipe fee earnings, when you can use cash in many cases? Removing your money from the bigger banks and supporting community banks will also greatly hinder plans for digital control.

The banks want your digital identity by any means necessary, which was covered in part 3, so mandating injections to have physical access to your bank is an obvious tactic banks will use. Morgan Stanley was the first big bank to ban unvaccinated employees and clients from its New York location.

McKinsey & Company used Covid-19 for making the case for “robust digital financial infrastructure” that is tethered to a digital ID.

“The effectiveness of the 12 Covid-19 programs we analyzed depended greatly on the presence of the three structural features of financial infrastructure: digital payment channels, the presence of a basic digital identification system with broad population coverage, and simple data on individuals and businesses that are tethered to the ID.”

As seen in the section above on blockchain, that is where they are headed with all of this. Gartner Inc. forecasts new uses of blockchain could generate $3 trillion in value by the end of the decade.

The Depository Trust & Clearing Corporation (DTCC), who does $2.2 quadrillion in securities, has been changing up their services. In 2017, they announced plans to utilize blockchain technology for credit default swaps, in collaboration with IBM, Axoni, and R3CEV. Axoni is backed by Goldman Sachs, JPMorgan, Wells Fargo, and ICAP, as well as others. Once implemented, the blockchain-based credit default swaps platform will process up to $11 trillion on a yearly basis.

In 2020, the European Commission contracted with BlackRock to carry out a study on integrating environmental, social and governance (ESG) objectives into EU banking rules. As discussed in the Corey’s Digs report on the financial takeover, this is already being done in the U.S. as well. The aim is to use climate change as a way to monitor how you are spending your money; if we allow this to continue, they will soon be assigning you an ESG-based credit score as well as a social credit score.

Remember, while there are 12 regional Federal Reserve banks, the New York Fed is the most important. It is the only regional branch with its own trading floor; it also houses the Exchange Stabilization Fund (ESF) and is the only permanent member of the Federal Open Market Committee (FOMC), which buys and sells U.S. government securities. The majority of the programs carried out under the guise of the pandemic response were run by the New York Fed.

Money Is Flowing In

Before getting into crypto and digital, it’s critical to understand that those allegedly funding the “pandemic” are really utilizing those funds to build the human enslavement system and smart grid infrastructure with heavy surveillance over humanity. This is just one area where major slush funds have been put into position for years, building up to this moment in time where they go “all in.” The same folks have been contributing for years as well to the HIV/AIDS Global Fund slush fund, founded by Bill Gates and others.

The individuals and companies that are profiting from the pandemic are also heavily involved in the technology and digital currency future. Money is flowing in through COVAX—founded in April 2020 by the WHO, European Commission, and government of France—a worldwide initiative to get Covid-19 injections out to the world via Bill Gates’ Gavi. COVAX is also co-led by CEPI, which of course is also an effort of Gavi, the WHO, and UNICEF.

CEPI has joined the Wellcome Leap Fund (created by the Wellcome Trust last year) in a $60 million program to support a network of RNA-based biofoundaries for access to diverse biologics, including mRNA vaccines and monoclonal antibodies. Wellcome Leap is led by the former director of the Pentagon’s DARPA, Regina Dugan; the chairman of the board, Jay Flatley, is the former long-time head of Illumina, the largest maker of DNA sequencers. Wellcome Leap’s goals seem to align with the merging of AI and humans, and with extensive surveillance measures. Journalist Whitney Webb did an extensive report on this.

China has been funding Gavi since 2015, and on June 4, 2020 it made a pledge of another $20 million to run through 2025. Greece has pledged $1.8 million to COVAX. The Netherlands, one of the original six donors to Gavi, has pledged over $365 million to Gavi. Norway, also one of the original six donors, has contributed a whopping $1.14 billion to Gavi. The U.S., Gavi’s top donor and one of the original six, has given well over $2.5 billion to Gavi. Those are just a few countries tied in with Gavi. Scroll down on any of the Gavi links above to look up other countries and donors.

Numerous companies have also contributed funds to Gavi and COVAX. Shell, which is a WEF member, has pledged $10 million. Other WEF members that have made sizeable pledges include TikTok ($10 million, parent company ByteDance), UPS ($1.3 million), Unilever ($2.3 million), and Mastercard ($5.3 million), to name a few.

Another big funder of COVAX ($5 million thus far) is Wise (formerly TransferWise), a London-based global online money transfer service that supports more than 750 currency routes across the world and is making an impact on an international level. Wise was founded in 2011, with funding from Richard Branson, Peter Thiel, PayPal co-founder Max Levchin, and others. Wise has partnered with banks and companies such as Bolt, GoCardless, and Monzo, which recently applied for a U.S. banking license.

In other words, it is the same network of people over and over again, plotting out the next manufactured crisis, swooping in to collect money to save the day, and building new industries that enslave humanity.

Where is Cryptocurrency Heading?

As already noted, the Infrastructure Investment and Jobs Act that passed in the Senate is really about building out the “smart grid,” which means getting everyone plugged in, QR-coded, and on the blockchain for total surveillance and governance. Part of that governance includes regulating cryptocurrency with the hopes of generating $28 billion in tax revenues. The Act also includes very broad language for “brokers” to be responsible for reporting, so everyone in the crypto industry is waiting patiently for a more detailed description. The implementation is not set to take place until the end of 2023, and the House is still working on modifications, so it’s a wait-and-see situation at the moment.

Either way, it seems crypto is headed toward some level of regulation and reporting mechanisms to ensure a tax cut. Ultimately, once the central bankers have established a digital currency, which is fully trackable, they may try to do away with crypto altogether.

In Beijing,, the world’s largest bank is now running 30 blockchain applications so customers can trace their health care coverage and see how their philanthropic donations are being spent. In May, China banned financial institutions and payment companies from providing any service related to cryptocurrency transactions, while at the same time piloting its own digital yuan currency. In spring 2021, the International Finance Forum (IFF) held its annual conference in Beijing to discuss the post-pandemic era and a “sustainable” future, which included a presentation on blockchain by RChain’s founder. Former World Bank president Jim Yong Kim, IMF President Kristalina Georgieva, and UN Secretary-General Antonio Guterres were all in attendance as well.

In the U.S., it seems that many financial institutions are getting on board with crypto, for the time being, as it may be a while before they move to a CBDC. For example, New York’s Signature Bank, is serving institutional crypto customers so they can deposit money in their crypto trading account through the bank’s Ethereum-based Signet platform. In 2020, crypto deposits increased from $2 billion to $10 billion. In 2019, Harvard University invested in the crypto market, joining two other investors in an $11.5 million backing of Blockstack Inc., a cryptocurrency company. Harvard even offers an introductory course on blockchain and Bitcoin. According to the Harvard Crimson, Harvard Management Company (the firm that manages the university’s $41.9 billion endowment) has been investing in Bitcoin since 2019.

A Crypto Climate Accord?

On April 8, 2021, Energy Web, Rocky Mountain Institute (RMI), and the Alliance for Innovative Regulation (AIR) launched the Crypto Climate Accord. Inspired by the Paris Climate Agreement, this alliance, consisting of over 150 partners, is seeking to make the cryptocurrency industry 100% renewable by 2025 or sooner. They want to enable all of the world’s blockchains to be powered by 100% renewables, develop an open-source accounting standard for measuring emissions, and achieve net zero emissions for the entire crypto industry—including all business operations beyond blockchains—by 2040. Some of their partners include Argo Blockchain, Bitcoin Latinum, Blockchain Founders Fund, CoinShares, Consensys, DMG Blockchain Solutions, Gryphon Digital Mining, NortonLifeLock, RChain, Ripple, Skyline Renewables, Tom Steyer, Vancrypto, plus over 100 others. Of course, they are also supported by the United Nations Framework Convention on Climate Change.

For those who may not know, RMI was founded in 1982 by Hunter Lovins and, in December 2014, merged with Richard Branson’s Carbon War Room to become a subsidiary under RMI. Both companies played a major role in the Ten Islands Pilot program to bring renewable energy to ten islands, which eventually evolved to over 23 islands and expanded to the tourism industry, reported on extensively in Corey’s Digs. The program involves a lengthy list of players, who coincidentally are many of the same players featured in this series, including 26 governments, the Clinton Foundation, George Soros, Reid Hoffman of LinkedIn, Bill Gates, Jeff Bezos, Mark Zuckerberg, Jack Ma of Alibaba, Marc Benioff of Salesforce, and countless organizations and NGOs. The former disaster risk management specialist for the World Bank and UNDP development specialist, Justin Locke, became the director for the “Islands Energy Program” for RMI in 2014. Former President Barack Obama and the Department of Energy played a big role in this rollout as well.

Energy Web was co-founded by RMI and Grid Singularity in 2017, along with 10 founding affiliates. The Alliance for Innovative Regulation was launched in 2019 by co-founders Jo Ann Barefoot and David Ehrich, both with extensive backgrounds, with the board consisting of a former senior White House advisor and former comptroller of the currency.

Bitcoin is concerned about this new Crypto Climate Accord, questioning its true motives. Noting that the enormous level of energy consumption required to run high-performance computers and meet the demands of this rapidly evolving industry will certainly leave a large energy footprint, they question whether billionaires and industry evangelists are suddenly regaining a conscience to restore the planet’s ecosystem, or if this is simply a gimmick designed to suppress criticism and provide good PR? They point out that nearly all of the signatories are already using a less energy-intensive proof-of-stake (PoS) consensus protocol, so over time, crypto’s energy footprint will automatically decline, which shows these companies are merely promoting themselves as “green” to attract more users, rather than actually addressing any environmental concerns. Being as the Accord signatories are a self-governing body with no oversight, it seems “self-serving” may be the true motive.

Devolving Into CBDCs

This is where it gets tricky, and turning to the brilliant reporting of John Titus of The Solari Report for insight is always helpful. There is quite a dance taking place, not to mention the heated competition among financial institutions and Big Tech, and understanding the logistics of how this could all roll out on the back end gets a little complicated. The biggest issue is in how these entities are going to distribute the CBDC. Will it come from the Federal Reserve or the Treasury? Will it go directly to commercial banks, and how will it get funneled out to retail and people? What or who will be the collateral against it? One thing we know for certain; it will function across a blockchain (distributed ledger) platform that will be fully traceable, which is quite different from how cryptocurrency works. The central banks aren’t going anywhere, at least not any time soon, but Big Tech is already making its moves into the banking industry.

In December 2020, the Bank for International Settlements’ Innovation Hub (BISIH) Swiss Centre, Swiss National Bank (SNB), and SIX carried out a successful proof-of-concept CBDC experiment that integrated tokenized digital assets and central bank money. In its press release, BIS stated it had issued a wholesale CBDC onto a distributed digital asset platform; linking the digital asset platform to the existing wholesale payment system, it demonstrated “feasibility and legal robustness of both alternatives in a near-live setup.”

In July 2021, the European Central Bank’s Governing Council launched a 24-month investigation into a digital euro, focusing on key issues regarding its eventual design and distribution.

Also in July, U.S. Treasury Secretary Janet Yellen convened the “President’s Working Group on Financial Markets (PWG)” to discuss the potential benefits of stablecoins. Yet, that same week, Federal Reserve Chair Jerome Powell stated, “you wouldn’t need stablecoins, you wouldn’t need cryptocurrencies if you had a digital U.S. currency.“

Who Will the Bankers Become in a Digital World?

“We’re understanding the concerns they may have, how CBDCs could be issued. Each government is going to go at a different speed, but there isn’t one government that isn’t envisioning a future with digital fiat currency.” ~ Dan Schulman, CEO of Paypal

There are currently 4,357 commercial banks in the U.S., down 2,789 since the 2008 financial crisis. In the last 15 years, the Fed approved 3,576 bank mergers, with no denials. In 2016 the Comptroller of the Currency announced it would begin issuing new Fintech Banking Licenses to allow financial technology companies to expand across the country more quickly.

In 2020, the OECD published Digital Disruption in Banking and its Impact on Competition. The United States is one of the OECD’s 20 founding members and is the largest financial contributor. The report analyzes possible strategies of Fintech and Big Tech players and the role of regulation, discerning that regulation will decisively influence how involved Big Tech will become within the industry and who the dominant players will be. The report also explains that the supply and demand drivers of the digital disruption is driven by technological developments on the supply side, and by the consumer expectation of service on the demand side. Application programming interfaces (APIs), cloud computing, smartphones, digital currencies, and blockchain technology make up the supply.

According to the report, the United Kingdom, United States, Singapore, Germany, Australia, Hong Kong, and China are the leading Fintech hubs, with China leading the way through Big Tech giants such as Alibaba, Baidu, and Tencent. OECD states that Big Tech platforms (companies such as Google, Amazon, or Facebook, for example) are much more disruptive to the traditional banking business due to their broad customer base, reputation, less regulatory limits, and extensive amounts of customer data (though one might argue that their reputations have been declining). These companies believe that due to all of their advantages with a large installed customer base, they can compete head-to-head with incumbent banks by becoming either intermediaries (and adding traditional banking products) or marketplaces that focus on the most profitable banking activities. The OECD report also suggests that Big Tech firms could monopolize digital payments by denying interoperability with other eMoney providers, which means they would control the interface of the customers, and banks would have to compete to supply products and services through their platforms.

Big Tech companies definitely have a stronghold in the digital world and can act as gatekeepers to the distribution of financial products. Most banks won’t be able to compete with their bundled product strategies, so they may opt to transform their business into an open platform with other banks and financial intermediaries, or partner with Big Tech firms. Controlling the interface with customers is critical. Already, Amazon and JPMorgan Chase have formed a partnership; Apple and Goldman Sachs have partnered to offer credit cards; Amazon and Bank of America have partnered in loan provision; and Google has been partnering with multiple financial institutions. All in all, the OECD report points out that if Big Tech firms enter the banking sector in full force (they’ve already begun), banks will have limited options for staying in business unless they provide specialized unique financial products that Big Tech firms cannot offer, or they become platforms competing with Big Tech (since they are able to navigate regulations better).

OECD concludes that Fintech firms will divide into specialized firms with no banking license, and digital banks. The specialized service firms will partner with incumbents, and the digital banks will consolidate or sell to the incumbents. Big Tech will continue its new venture into banking services. As regulations evolve, which will include who controls the data, that will determine just how far Big Tech can go on its own. Some might say it’s the obvious marriage—Big Tech and Big Banks.

Big Tech Making Its Moves into Banking

Using PayPal and Google as two case studies, we can see the direction in which Big Tech companies are heading and the impact they are having.

PayPal is gunning for a leading position in the future of digital assets and currencies. “This whole idea of establishing a cryptocurrency and blockchain unit within PayPal is how we can be a shaper of that [trend], a leader of that, and not a reactor,” said CEO Dan Schulman last May. In April, PayPal acquired Curv Inc., a crypto security firm based in Tel Aviv; in February, PayPal opened a Visa-branded Venmo credit card, and last year PayPal launched QR codes for in-store transactions, which racked up $6.4 billion in one quarter alone. The company piloted its QR code in 28 countries during the so-called pandemic via PayPal Wallet (to allegedly help small and medium-sized businesses) but didn’t include the U.S. in th3 pilot program, only launching it here afterward.

PayPal-owned Venmo processed nearly $160 billion in transactions in 2020. PayPal also provides a Paypal Cash Mastercard, prepaid Mastercard, cashback Mastercard, extras Mastercard, Paypal credit (a reusable credit line that allows you to pay off a purchase within six months with no interest or annual fee), and “Pay in 4,” which allows you to pay for a purchase in four installments two weeks apart (also interest-free). PayPal has even partnered with Bancorp Bank and others in order to provide FDIC insurance on the credit cards it offers. If you have a PayPal cash card, the company will deposit your funds into a pooled account that is held by PayPal at an FDIC-insured bank. PayPal has also partnered with WebBank, a Steel Partners Company, to offer business loans. So essentially, PayPal is already operating as a partial banking system but doesn’t provide checks, auto loans, mortgages, or wealth management. That seems like an easy area for big banks to slide into, using PayPal as the middle-man interface. The company even has a system in place to pay your taxes directly to the IRS.

That said, would PayPal and other Big Tech firms become a controlled gatekeeper for the larger banks and choose not to partner with smaller banks in the future, forcing mergers, acquisitions, and a monopoly? In January, JPMorgan Chase & Co. CEO Jamie Dimon went on a rant about “unfair competition” because of the audacity of competition from tech companies and smaller banks. Apparently, while regulation requires banks to put two unaffiliated networks on every debit card they issue, with retailers then having the ability to choose which network handles a transaction, banks with assets under $10 billion are exempt from this regulation. This allows tech players to partner with small community lenders and obtain bigger fees, which of course the big banks don’t approve of. So in January, Dimon made this threat:

“There are examples of unfair competition which we will do something about eventually, people who make a lot more on debit because they operate under certain things, the only reason they can compete is because of that. You can expect that there will be other battles that take place here.”

Seven months later, the SEC opened an investigation into PayPal over whether the swipe fees paid to the banks that issue PayPal’s debit cards meet Federal Reserve guidelines. The Federal Reserve is now weighing changes to its rules governing debit cards, after the central bank asked for public comment on an amendment in May.

JPMorgan Chase has signed up over 400 banks, including Deutsche Bank and Mexico’s Banorte, for Internet banking transactions, using its Liink blockchain network. The goal is less paper checks and more online transactions.

Google has been busy building partnerships with banks to provide actual checking accounts through its new Google Plex, which is integrated with Google Pay. Thus far, Google has partnered with 11 financial institutions, including Citi, BMO Harris, and Stanford Federal Credit Union. Google Pay already operates with 5,000 financial institutions, so they are pitching partnerships to banks and credit unions:

“You’re lagging in technology. Your current vendors are years behind. Consumers think you’re irrelevant. We’re hip, we’re cool, we have all the latest technologies, and boy have we got data! Come partner with us on our new checking account!”

Google Pay has quite a bundle—from Plex to Verge to Explore (which uses a QR code), to shopping, insights to track your spending, and more. Google also provides cloud computing services to financial institutions.

In fact, Equifax utilizes Google’s cloud. Credit scoring company Fair Isaac announced on January 23, 2020 (right after Covid hit) that it was changing the scoring system, making it harder for people to get loans. Equifax made the change first in summer 2020 (but Freddie Mac and Fannie Mae still have to go by the old scoring system). In 2018, Equifax spent $1.2 billion to move all its data to Google Cloud. Of course, Equifax alleges it implemented this due to a data security breach. Equifax is a partner with WEF, and the WEF and others have already explained how the future of credit scoring will be different and will include a social and climate score.

Banking Licenses

Many of the big techs seem to be staying away from the banking licenses and partnering up with banks instead, likely to avoid dealing with regulation headaches. Banking licenses are very costly and come with strict regulations, but can also provide FDIC insurance. To obtain a license a financial company has to meet a strict set of regulations, keep financial reserves on hand, and ensure data systems are secure. However, some tech companies are taking it all the way. There are four types of banking licenses:

A) Traditional license: what most banks have

B) Extended license: allows a fintech company to partner with a parent bank to operate under their license

C) Fintech (virtual) license: available to digital-only banks operating solely online. This newer banking license was announced by the OCC in December 2016, to allow financial technology companies to expand across the country.

D) E-money license: allows companies to offer payments and financial services such as transfers and currency exchange, but not manage deposits and operate like a bank

Some tech companies have recently filed or secured a banking license:

Adyen, a Dutch payment company based in the Netherlands, was recently approved to establish a U.S. federal branch license in San Francisco, CA.

Monzo Bank Ltd, an online bank based in the UK, has filed for a banking charter in the U.S.

Revolut, a financial technology company based in London England, has filed for a bank license in the U.S. The company launched in 2015, is currently valued at $33B, and just last month raised $800M in a funding round. SoftBank’s Vision Fund 2 and Tiger Global Management led the deal. Alibaba founder Jack Ma previously served on the board of SoftBank.

SoFi (Social Finance Inc), an online personal finance company, received a conditional approval for a national bank charter allowing for it to receive deposits and make loans on its own.

Square was approved for a banking license last year to form a Utah-based bank.

Varo Bank, a subsidiary of fintech Varo Money, Inc, received approval of a national bank charter.

What About Government-Run Banks?

Is it possible that we will begin to see public banks popping up, run by government? As of right now, the only public bank in the U.S. is The Bank of North Dakota, but they are a state-owned wholesale bank that actually helps the little guys. Essentially, public banks could wipe out community banks, so it’s not something we want to see happen.

Why is this a plausible option? In 2020, Sen. Bernie Sanders called for a government-run banking system that would be set up through the Federal Reserve and U.S. Postal Office. This was proposed through the Biden-Sanders “Unity Task Force” which called for a new public banking infrastructure. This was another “idea” based on helping low and middle-income families establish bank accounts with real-time payment systems. Though, Federal Reserve Chair Jerome Powell didn’t seem to be on board with this concept, the Washington Post touted it as something that needs to become a reality. Of course they all sell it as an advantage, as though a “public bank” means it’s all about the people and how much more secure everyone will be vs with a private bank, leaving people to forget the fact that they would be government-run.

The World Economic Forum is on board with public banking as well. In fact, they published an article in October 2019, regarding California’s recently enacted public-banking law. In it, they stated:

“The banks must be governed well to stay on mission, and the governance regime itself must be monitored to ensure that it remains both effective and complementary to that mission. At the end of the day, mission drift may be unavoidable. But detecting it and instituting the necessary governance reforms is well within governments’ power. It would be a tragic mistake to assume that passing a public-banking law amounts to mission accomplished. The mission has only just begun.”

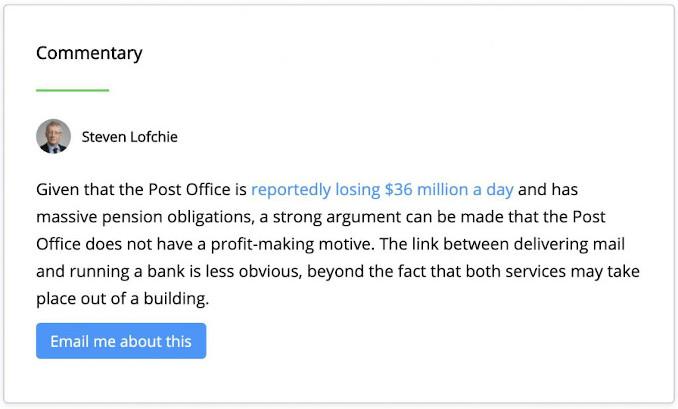

They’re not the only ones trying to sell this new banking model. The House Financial Services Subcommittee discussed it in July 2021, during their hearing titled ‘Banking the Unbanked: Exploring Private and Public Efforts to Expand Access to the Financial Systems‘. They assessed proposed legislation, and all put in their two cents, with several in favor of public banking. The eye-catching statement by Steven Lofchie was telling. He suggested that since the Post Office is reportedly losing $36 million a day and has massive pension obligations, a strong argument can be made that the Post Office does not have a profit-making motive. Ah yes, the great “crash” of the Post Office is coming full circle now.

Could it become a reality? Let’s take a look:

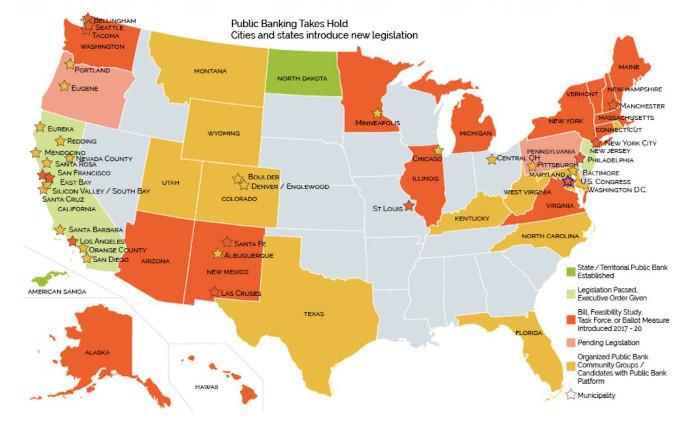

In 2019, Gov. Newsom signed into law that California cities and counties will be allowed to establish public banks, making them the second U.S. state to allow it – North Dakota being the first. That seemed to have kicked things off, because in 2020 four Federal bills were introduced for public banking and postal banking. Postal banking has been around forever, so it wouldn’t be a stretch to expand on it, especially if they took it online as well. Some of those bills may be reintroduced or snuck into other bills since they didn’t make it through in 2020.

As of this year, there has already been legislation introduced from eight different states: California, Hawaii, Massachusetts, New Mexico, New York, Oregon, Pennsylvania, and Washington. The Public Banking Institute has put together a map indicating what’s happening on the public banking front across the country, with all legislation linked below the map.

Here’s an example of one of three separate bills introduced this year in New York alone:

New York: Senate Bill S1762A “New York Public Banking Act” introduced on January 14, 2021. It would authorize municipal and other local government to form and control public banks through the ownership of capital stock or other ownership interest, and to loan or grant public funds or lend public credit to such public banks for the public purposes of achieving cost savings, strengthening local economies, supporting community economic development, and addressing infrastructure and housing needs for localities.

One can see how they could create government-run public banks and utilize the USPS website platform to expand it to include banking and financial products, allowing them to attempt to compete with Big Tech. All state and community websites could easily promote this to direct people to the USPS site as well. So this is something to keep our eyes on.

Current Financial Legislation Introduced To Keep An Eye On

Financial Inclusion in Banking Act – H.R.1711

Passed in the House on May 18th. This bill expands the duties of the Office of Community Affairs within the Consumer Financial Protection Bureau regarding under-banked, un-banked, and underserved consumers. Specifically, the office must (1) report on impeding factors for individuals and families that do not participate in the banking system, and (2) develop strategies to increase such participation.

Translation: Get everyone in the banking system to be able to control their money via a social and climate scoring system.

Corporate Governance Improvement and Investor Protection Act – H.R.1187

Passed in the House on June 16, 2021 with a 215-214 vote. It is sitting in the Senate. This bill requires an issuer of securities to annually disclose to shareholders certain environmental, social, and governance metrics and their connection to the long-term business strategy of the issuer. The bill also establishes the Sustainable Finance Advisory Committee that must, among other duties, recommend to the Securities and Exchange Commission policies to facilitate the flow of capital towards environmentally sustainable investments.

Translation: Monitor ESGs for climate scoring system via banks and investments to allow or disallow access to an establishment or spending capabilities.

Payment Choice Act of 2021 – H.R.4395

This is a positive bill that was introduced in July 2021 to protect American currency as a form of payment for goods and services. It would make it illegal for retail businesses to reject cash for in-person, consumer transactions at stores across the country. The bipartisan bill has 28 co-sponsors.

Additional Information

International Monetary Fund

Virtual Currencies and Beyond: Initial Considerations

Bank for International Settlements (BIS)

CPMI Paper: Digital Currencies

Augmented Humans & Artificial Intelligence

“This is a whole new era where we’re moving beyond little edits on single genes to being able to write whatever we want throughout the genome.” – George Church

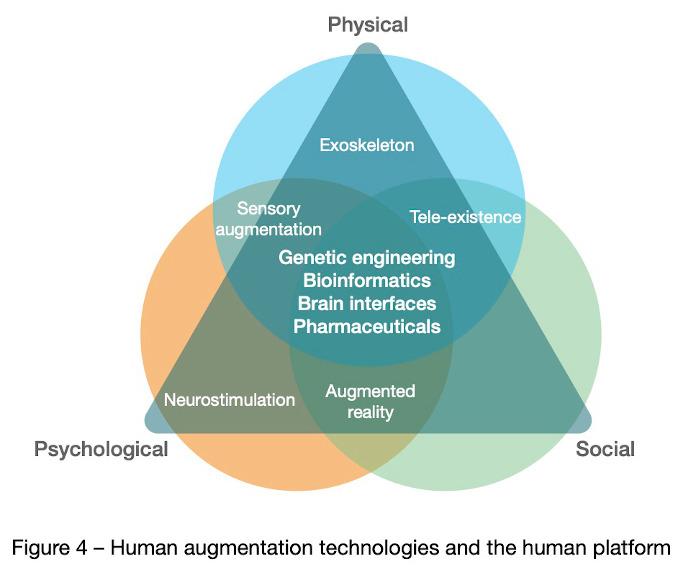

There is a lot to unpack in this section, as this is their ultimate goal – the “augmented human” who interacts with robots and trains artificial intelligence – all plugged in together, while the globalists solve their immortal life goal. In the interest of keeping this section from becoming too lengthy, much of it will be bullet points with referenced source material.

According to the UN, artificial intelligence is forecasted to generated nearly $4 trillion in added value for global markets by 2022.

- That National Security Commission on Artificial Intelligence (NSCAI), chaired by former Google CEO Eric Schmidt, was founded in 2018, as an independent commission of the U.S. for the purpose of making recommendations to the President and Congress to “advance the development of artificial intelligence, machine learning, and associated technologies to comprehensively address the national security and defense needs of the United States.” There are fifteen commissioners which includes individuals from Oracle, Microsoft, Google, In-Q-Tel, and Amazon.

- In July 2021, NSCAI held a Global Emerging Technology Summit on Artificial Intelligence where NATO’s Deputy Secretary General Mircea Geoană was one of the panelists. The Secretary General of the Organization for Economic Co-operation and Development (OECD), an intergovernmental organization consisting of 38 member countries, was also on the panel. The OECD works through over 300 committees, working groups, and experts in areas of policy making.

Discussions involved investments and partnerships in biotechnologies, big data, autonomy, military, NATO’s landmark strategy of AI, EU proposal for a transatlantic agenda for global cooperation, China’s edge on AI, OECD’s recommendations on neurotechnology, G7, and of course climate change. “I mean, pretty much we’re starting to think that machines can think like us. We’ve got unbelievable achievements in biotech, in robotics, of course, 5G as a platform to make it all happen,” said Oracle CEO Safra Catz. They state that NATO has the power of standardization which automatically becomes the gold standard.

- In June 2021, the OECD released their 93-pg report on the “State of Implementation of The OECD AI Principles” which has been adopted by over 46 countries and the G20 AI Principles as well. They are also focused on a regulatory and policy treatment of blockchain technology which they plan to have a public consultation on later this year. They have also set the standards for broadband and telecommunications infrastructure, “including the development of transparency reporting frameworks for terrorists and violent extremist content online,” in the 5G network rollout. Read that again.

Part of their strategy involves countries developing centralized, accessible repositories of open public datasets including government health records and satellite data. They promote initiatives that enable private sector data sharing. Pages 88-91 of this report list the AI network of experts working group on national AI policies with a breakdown of organizations and corresponding countries.

This entire report breaks down what is happening with AI, robotics, labor force, data collection, biometrics and digital control mechanisms across the world, going into detail in specific countries. It is far too much to cover in this report, but is a definite recommended read to understand the full landscape of their intentions.

- The National AI Initiative Act of 2020, which was implemented January 1, 2021, budget authorizes nearly $4.79 billion in funding for AI research at the National Science Foundation over the next five years, $1.15 billion at the DoE, and $390 million at NIST. The US National Security Commission on Artificial Intelligence (NSCAI), launched in March 2021, is calling for at least $8 billion towards AI R&D annually.

“The NSCAI final report presents an integrated national strategy to reorganize the government, reorient the nation, and rally our closest allies and partners to defend and compete in the coming era of AI-accelerated competition and conflict.”

The report also states that they want the government to stand up a task force and 24/7 operations center to confront digital disinformation and that biosecurity must become a top-tier priority. They go on to say that the U.S. should lead an Emerging Technology Coalition and establish a multilateral AI research institute for a global research hub, and that “the Department of State should be reoriented, reorganized, and resourced to lead diplomacy in emerging technologies.”

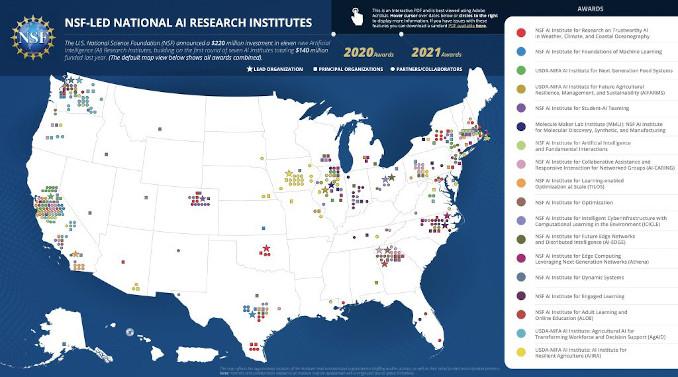

- The National Science Foundation (NSF) has an annual budget of $8.5 billion and funds 27% of the total federal budget for basic research conducted at U.S. universities and colleges. The Bill & Melinda Gates Foundation funded NSF $24 million in 2008 for agricultural development. NSF has created numerous AI Research Institutes across the U.S. Below is a screenshot of the interactive map on their website.

“We are faced with a gift from God, that is, a resource that can bear fruit of good.” – Pope Francis on artificial intelligence

- The $500 million U.S. government-funded Frontier supercomputer is set to launch in 2022, under the direction of the Department of Energy, at Oak Ridge National Laboratory managed by UT-Battelle LLC. It is one of the world’s most powerful and “smartest” scientific supercomputers with high performance computing and artificial intelligence, and is the nation’s first exascale system that can exceed a quintillion calculations per second, built by Hewlett Packard.

- The World Economic Forum is concerned that masks are interfering with facial recognition software, so they feel they should use technology developed by the Pentagon and NASA that can ID you from your heartbeat using a laser, referred to as CardioID. Their marketing spin? “Security in a heartbeat.” Forbes likes to call it “surrender to the rhythm,” but they’re not wrong about the fact that it’s straight out of the movie ‘Minority Report.’

- In 2019 Elon Musk gave a presentation about Neuralink brain-machine interfaces, a technology that he views as allowing a “merging with AI.” At that time, his goal was to have it in a human patient by 2020, but thus far has tested it on pigs and a monkey. Harvard professor Charles Lieber, an expert in nanotechnology and brain science, was one of the top scientists in communicating with Musk and Neuralink. Lieber is currently facing trial on federal charges for lying about his connection to Chinese universities, participating in their Thousand Talents Program, and not reporting income he received from Chinese government entities. Google and Dubai-based firm Vy Capital have contributed funding to get it off the ground.

- Elon Musk has also launched his Starlink satellite network this year, which are low-orbiting satellites said to provide high-speed internet access to people in remote areas. It consists of the worlds largest satellite constellation with more than 1,500 operating in a dozen countries.

- A month into the so-called pandemic, the Roman Catholic Church joined IBM and Microsoft to agree on a “universal ethical paradigm on artificial intelligence.” The UN Food and Agricultural Organization, Italy’s technology minister, and others also partook in this co-signatory venture. Pope Francis addressed some of his concerns but is in support of AI and robotics, and believes “we are faced with a gift from God, that is, a resource that can bear fruit of good.”