“The cost of interest alone on the nation’s $36 trillion debt carries a price tag larger than each of the annual budgets for Medicare ($839 billion) and the U.S. Military ($820 billion).”

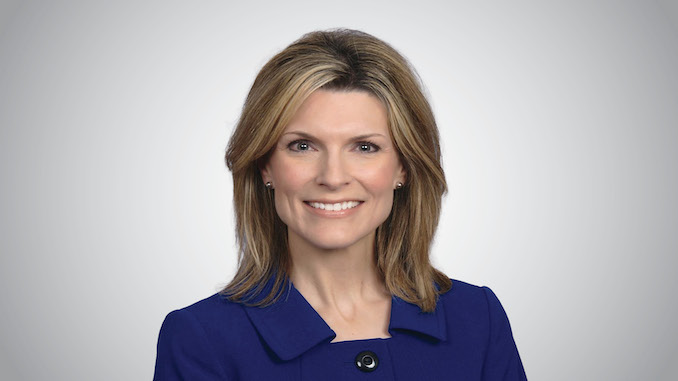

~ Elise Nieshalla

Indiana State Comptroller Elise Nieshalla and 36 other state financial officers are our pick for Pushback of the Week for spearheading efforts to get the new administration and Congress to take financial management and the U.S. debt burden seriously. On November 18, the 37 members of the National Debt Crisis Task Force for State Financial Officers—initiated and chaired by Nieshalla—sent a letter to President-elect Trump and Members of Congress, seeking to “ignite a much-needed sense of urgency” and pledging to help Congress develop and implement a long-term plan to restore America’s financial solvency.

In the letter—covered on Fox News and in a November 15 op-ed by Nieshalla in the Washington Reporter—the state financial officers expressed grave concern about the national security implications of ignoring the U.S. debt. Citing the federal government’s out-of-control deficit spending, the current $1-trillion-plus cost of servicing the national debt, and the rate of increase of the nation’s debt-servicing costs (up 30% from FY 2023), they noted that while the U.S. took 205 years to accumulate its first trillion dollars in debt, it is now racking up nearly $2 trillion in additional debt every year. They also pointed out that there has been nearly a 50% increase in federal spending since 2019, continuing “well beyond” the public health emergency used to justify some of that increase.

Nieshalla stepped into the job of state comptroller a year ago. As Indiana’s chief financial officer, one of her responsibilities includes managing the state’s retirement plans. She notes,

“The State of Indiana’s rock-solid financial foundation stands in stark contrast to the fiscal position of our nation…. [W]e have balanced budgets, well-funded pensions, healthy cash reserves and a AAA credit rating. In addition, Indiana is the seventh lowest debt per capita state in the country at $366, whereas the federal government’s debt per capita is over $100,000.”

We salute Nieshalla and the other state financial officers for their leadership on “making America financially solvent again.” Let’s make sure that the federal government has a response that rebuilds U.S. sovereignty and compliance with the Constitution—and does not issue more debt to fund mandated purchases of digital assets or make fraudulent use of our deficit to allow private parties to plunder our land and mineral resources.

Related:

Comptroller Nieshalla Leads Effort Seeking “Day One” Action from Congress on National Debt

Op-Ed: Comptroller Elise Nieshalla: Restoring America’s Financial Solvency

Letter from 37 State Financial Officers to President-elect Trump and Members of Congress

Related at the Solari Report:

Hero of the Week: January 8, 2024: State Treasurer Marlo Oaks