“Life is infinitely stranger than anything which the mind of man could invent. We would not dare to conceive the things which are really mere commonplaces of existence. If we could fly out of that window hand in hand, hover over this great city, gently remove the roofs, and peep in at the queer things which are going on, the strange coincidences, the plannings, the cross-purposes, the wonderful chains of events, working through generations, and leading to the most outre results, it would make all fiction with its conventionalities and foreseen conclusions most stale and unprofitable.”

~ Sir Arthur Conan Doyle, The Complete Adventures of Sherlock Holmes

By Catherine Austin Fitts

This week, attorney Carolyn Betts joins me to discuss Special Purpose Acquisition Companies (SPACs).

SPACs are essentially blind pools. Investors finance a company that has no business but is planning on acquiring another business. Among other things, this is a way for a private company to go public faster and do so with less regulatory scrutiny.

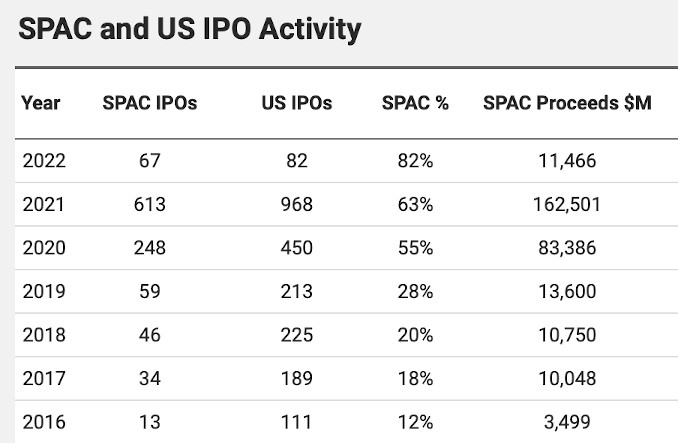

SPACs have traditionally represented a small portion of the United States initial public offering (IPO) market. However, after the G7 central bankers voted for the Going Direct Reset in August 2019, the volume of SPACs skyrocketed.

Source: SPAC Analytics

What happened and why? There are more than a few mysteries surrounding the explosive amount of money pouring into blind pools while the balance sheets of the Federal Reserve and global central banks were exploding and the small business sector was shut down or bankrupted. Are SPACs an investment craze fueled by central banker largesse, or a Going Direct laundry designed to target capital to specific investment teams and industries?

Think there is no money? Join us for our discussion of the financial tsunami that has poured into SPACs—a once-in-a-lifetime investment phenomenon that many of us missed while distracted by lockdowns.

In Money & Markets next week, John Titus and I will cover the latest events and continue to discuss the financial and geopolitical trends we are tracking in 2022. Post your questions for Ask Catherine or post at the Money & Markets commentary here.

Talk to you Thursday!