“Money has a history which is fifty centuries old, and filled with an experience too valuable and too dearly bought to be ignored or thrown away”.

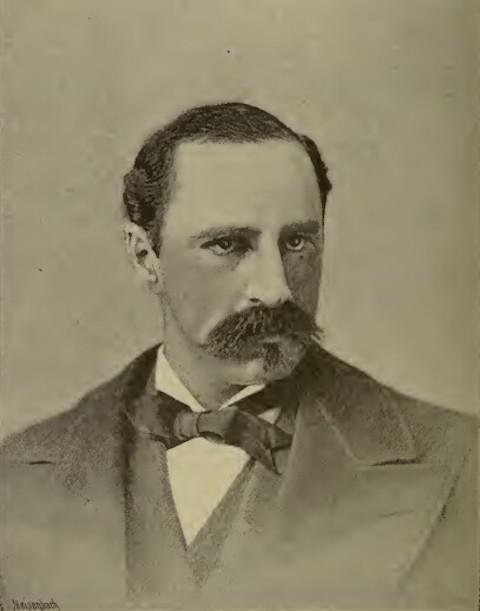

~ Alexander del Mar

By Catherine Austin Fitts

Alexander del Mar was an American author, historian, and monetary expert.

According to Wikipedia, del Mar was educated as a civil engineer at New York University and as a mining engineer at the Madrid School of Mines. He spent the first 12 years of his career as an editor until appointed as the first Director of the U.S. Treasury Department’s Bureau of Statistics (now part of the Bureau of Economic Analysis), serving in that position from 1866-1869. Also in 1866, del Mar was appointed the American delegate to the International Monetary Congress in Italy.

In 1869, del Mar purchased the National Intelligencer, which he moved from Washington to New York and published until 1872, when he again represented the United States at the International Monetary Congress in St. Petersburg, Russia.

In 1879, del Mar published his book A History of the Precious Metals, after 22 years of research. From 1880 on, he focused on writing monetary history, publishing A History of Money in Ancient Countries in 1880 as well as the following titles:

- The Science of Money (1885)

- Money and Civilization (1886)

- History of Monetary Systems (1895)

- A History of Monetary Crimes (1899)

- The History of Money in America (1899)

- A History of Monetary Systems of France (1903)

Some works by del Mar were announced but not printed, including The Politics of Money and The History of Money in Modern Countries. (CAF note: It is easy to guess why these might not have made it into print.)

Del Mar served as editor-in-chief of American Banker (a financial services trade publication) from 1905 to 1906. Upon his death in 1926 at the age of 90, he donated his private library of 15,000 volumes to the American Bankers Association.

Alpha Editions republished a new edition of A History of Money in Ancient Countries from the Earliest Times to the Present – now in the public domain – in 2019. This history covers the monetary systems of 16 civilizations, with a special focus on China and the Roman Empire. Other ancient civilizations discussed include those of Japan, India, Ariana, Bactria, Caubul, Afghanistan, Aboriginal Europe, Greece and its colonies, Carthage, Etruria, Persia, Assyria, Babylon, and Palestine.

Following del Mar’s older style of writing can make him difficult to read, but the wealth of information and insights he provides makes the effort worthwhile. Del Mar argued that currency is older than text – money preceded our communication with writing. He also made clear that different societies called for different models of monetary tools – currency cannot be separated from the culture, resources, technology, and nature of the people it serves. Creating and operating a currency system is both a complex and challenging affair.

While discussing the wide range of materials that have been used to make currencies, from tortoise shells to paper, del Mar concluded that gold and silver – in other words, commodity currencies – were risky affairs, leaving societies and economies dependent on the vagaries of the mining industry and external supply and demand.

Two cross-cutting problems that plague all currency systems are counterfeiting and debasement. If you cannot prevent them, you are in for a world of hurt. (CAF note: If you want to see the pain caused by debasement, simply look around you today.)

One question that del Mar did not address concerns the supply of gold and silver through history. Civilization after civilization has expended effort on mining – yet one society after another is impacted by short supply. I would like to see an inventory of mining versus available bullion for the last 50 centuries. It’s hard to believe all the shortages have been caused simply by the natural expansion of economic activity. Where is all the gold going?

Del Mar’s most important insight had to do with the essential role of the rule of law in the growth and valuation of a currency. It appears that the quality of governance of a society and its economy are far more important than commodity backing. It is the power, size, and endurance of the deepest social covenant that produces the finest currencies.

Fancy that.

Before we try to solve our currency debasement and credit corruption problems by backing currencies with gold or “trustworthy” digital machine and software technologies while ignoring the health of our children and the quality of our soil and water, we should ponder the lessons of history.

Who governs? If you want a trustworthy currency, you must emerge it from a trustworthy governance and legal system and related culture.

Whether in the board rooms of JPMorgan and the New York Fed, or in workshops on “sound money,” or in the crypto exchanges around the planet, the core issue remains to be faced and addressed. What is our covenant? And who will bring and enforce the law? The crypto world has been allowed to run up their market capitalization to $3 trillion unencumbered by current law and regulation. What happens when and if existing law enforcement lowers the boom once “health” passports and central bank digital currencies are in place?

The “New World Order” contingent believes they can ignore these questions by replacing currencies with a digital financial transaction system that achieves total central control – supported by a wide array of visible and invisible weaponry, including mind control weapons. With blockchain technology, central bank digital currency (CBDC) is likely to be directly or indirectly collateralized by humans themselves, and humans’ energy skimmed to run it.

If you read del Mar, you will appreciate why the introduction of “health” passports and CBDCs is a uniquely modern monetary experiment made possible by digital technology and global satellite systems. You will also appreciate the 50 centuries of frustrations that helped deliver today’s central bankers into the current psychopathy. And, of course, ancient history reminds us that slavery is still the oldest and most profitable business on the planet.

A History of Money in Ancient Countries from the Earliest Times to the Present delivers a chilling reminder as to why it is essential to reject an all-digital monetary system and focus our attention on the governance of our financial systems rather than just the financial tools themselves.

Bank for International Settlements (BIS) General Manager Augustín Carstens discussing CBDCs at 2020 IMF panel

Take Action:

Vaccine Passports, I-IV

Related reading:

Alexander del Mar (Wikipedia)