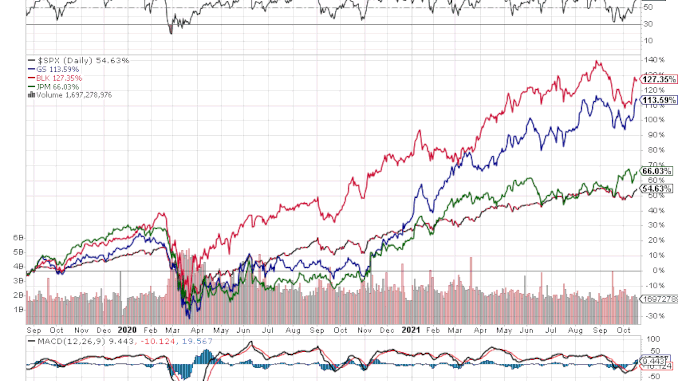

Since BlackRock’s “Going Direct” reset was voted on August 22, 2019, BlackRock stock has outperformed the U.S. stock market by double.

By Corey Lynn

It’s very likely that only a small percentage of people even know who BlackRock is, despite the fact that it is the world’s largest asset management company with over $9 trillion in assets, is one of the top two shareholders of over 1,600 American firms, was involved in the clean-up of the 2008 financial meltdown, pulled off the biggest scandal in history with the Federal Reserve last year, and is changing the way banks and financial institutions monitor your money while creating a new climate scoring system as another way to control your funds. Their finger isn’t just on the pulse, it’s on the lever.

BlackRock was founded by Laurence (Larry) Fink in 1988 under the corporate umbrella of The Blackstone group, later split from Blackstone in 1994, and went public in 1999. If Larry Fink isn’t on your radar, you had better start paying attention. Familiarize yourself with what BlackRock is behind, what they’ve already done to negatively impact you and our economy, and what’s coming down the pike so you can stay ahead of it. Here are a few very important reads:

- Going Direct Reset Summary

- Financial Takeover & Your Bank Account

- Who Owns Big Pharma & Big Media?

- Larry Fink’s 2021 Letter to CEOs on Net Zero Commitments

Story continues here.