“Transactional freedom [is] as important as freedom of expression under the 1st Amendment.”

~ Robert F. Kennedy, Jr

“The law? The law? I don’t have to obey the law. I report to a higher moral authority.”

~ Secretary Jack Kemp on why a HUD regional administrator could ignore a recent court decision regarding agency operations and finances

By Catherine Austin Fitts

At the Nashville Bitcoin conference last week, presidential candidate Robert F. Kennedy, Jr. proposed that if elected, he would issue a series of executive orders to implement radical policies related to Bitcoin (BTC), U.S. taxation, and real estate investment. See video above and transcript of remarks here.

The Solari team has prepared a series of questions to help us understand what Kennedy and his advisors are proposing. We encourage our subscribers to post additional questions in the comment section and readers to repost and discuss on their forums.

Mr. Kennedy:

- You propose moving assets from the Department of Justice (DOJ) Asset

Forfeiture Fund to the U.S. Treasury. If any of these seizures are

unjustified and therefore rightfully contested by BTC holders, what

will that do to the people who are trying to preserve their BTC? Will

such a precedent significantly increase the chances that aggressive

BTC seizures by over-eager prosecutors become easier in the future,

with no ability on the part of the honest BTC holder to stop seizure

other than by filing a complaint in court against the government? - Coinbase Custody serves as custodian for many of the largest

BTC ETFs. They also have the contract to serve as custodian for

BTC managed by the U.S. Marshals Service. Do you intend for the U.S.

Treasury to enter into a similar contract or will the New York Fed manage

the custodian service? - On what legal basis can a President move billions of assets from

DOJ to the U.S. Treasury without the consultation and approval of

the relevant Congressional appropriation (or other) committees? - Do you intend for any of the BTC you propose to be held by

Treasury to be held in the Exchange Stabilization Fund? Do you

intend for any of the Treasury BTC to be available to New York Fed

members to purchase for Bitcoin ETFs or other forms of collateral? - At current market prices, you are proposing that the U.S. Treasury

purchase $280 billion of BTC. You suggest, however, that this will

raise the market cap from the current $1.5 trillion to hundreds of

trillions of dollars so, presumably, the cost to taxpayers will be

much more. How do you intend to authorize such purchases based

on an executive order and without Congressional authorization,

appropriation, and oversight? Under this scenario, are you certain that

the crypto system is prepared to execute the 550 BTC per day

volume of transactions? - What funds will Treasury use to make the proposed BTC

purchases? Most Treasury funding comes from taxes paid by

individuals as well as from Treasury bonds sold to investors,

including U.S. pension funds and retirement accounts. Have you

calculated the market fees payable to BTC dealers in exchanging

dollars for BTC? - Current surveys suggest that no more than 20% of U.S. citizens

own BTC or crypto. Are you planning on using the taxes and

retirement savings of 100% of the everyday working citizenry to

create windfall profits for Bitcoin holders and the “Bitcoin

billionaires”? How does this fit with your views on the goal of

reducing economic inequality? - How much of the campaign donations you have raised to date

have come in the form of BTC and crypto? If you propose to take

actions that will raise the value of BTC by 100X or more, will that

“pump” the price of BTC before the election? - If you help increase the BTC price with your proposals that

benefit BTC investors, will that help you raise more donations from

grateful BTC holders? - Are BTC pump kickbacks an explicit funding strategy for your

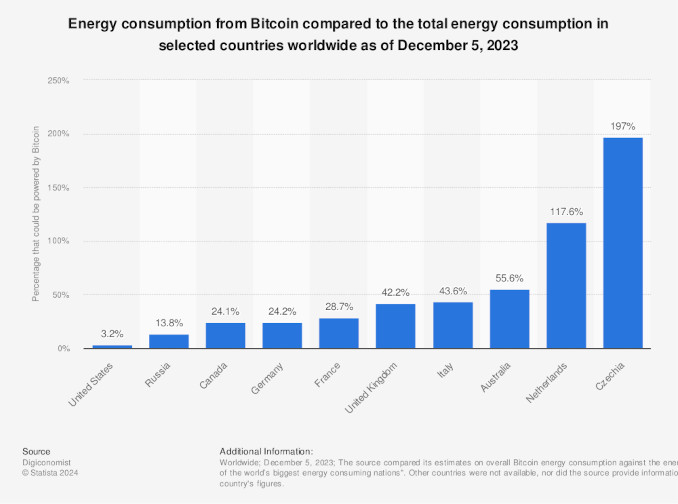

campaign? - BTC currently uses approximately 1.17X the electricity used by

the Netherlands. What will your proposal do to the energy

consumption of BTC and other crypto? Where will the energy

come from? What will this do to energy prices paid by the American

people and global consumers? What will the environmental impact be? - How will your proposal that BTC-to-dollar transactions be non-

reportable and not taxable impact federal and state tax collections? What

will your proposal do to attract retail funds to purchase BTC and

leave real assets? Will this benefit the investors currently trying to

acquire and control real assets, such as farmland and water resources? - Your proposal that BTC become a “like kind asset” for purposes

of Section 1031 of the Internal Revenue Code—which would enable owners

of real estate to “exchange” real estate holdings for equal value of

BTC with no capital gains tax due—would greatly reduce U.S. income

tax revenues paid by large real estate investors and large Bitcoin holders, would it not? Doesn’t that mean that the common people will be paying more

taxes to make up for the shortfall? Does this means that the Bitcoin

“billionaires” will have tremendous power in the ongoing land grab

in America? - What is the justification for deregulating crypto transactions that

would otherwise be subject to SEC rules, when other non-crypto

transactions having similar characteristics are regulated in order to

protect investors from fraud and require material disclosure? How

will fraudulent crypto transactions be regulated, if at all? - How can you institute major, radical changes in U.S. tax policy by

executive order and without Congressional authorization? Is this

legal? - Given these proposals in combination, can’t the wealthy devise

strategies to stop paying U.S. taxes completely? Can large banks and

corporations reengineer their operations to operate with BTC to

avoid all taxes? By sheltering the rich and powerful from significant taxes, do

you intend to attract capital to the U.S. from global markets? What

will the impact be on countries in the emerging markets struggling in

U.S. dollar debt traps? Is this how your policy helps assure U.S. dollar

dominance? - When new laws and regulations are passed or adopted, the

American people typically have the opportunity to study and

comment. This does not happen with executive orders. Given the

potential impact on domestic and global inequality of tax burden,

financial wealth creation, and land and asset ownership, do you

feel the American people and their representatives should have the

opportunity to comment on these policy changes before they are adopted? - The Israeli Bitcoin community has been a leader in developing the global BTC market. What will be the impact of your proposals on Israel and its push to be a leader in dominance of the Internet? What will be the impact of large windfall profits on the Israeli and Zionist communities and other global clusters (for example, Switzerland) involved in early BTC development? Will your proposals be another example of using U.S. tax collections and retirement savings to fund benefits to Israel? How do your BTC proposals relate to your strong support of Israel and its Gaza genocide? How do they relate to the expansion of war currently underway in the Middle East?

Thank you for considering these questions. We look forward to your response.

Related Videos:

- Robert F. Kennedy Jr. Remarks – Bitcoin 2024

- Robert F. Kennedy Jr. Keynote – Bitcoin 2024

- Donald Trump Remarks – Bitcoin 2024

- Bitcoin 2024

Related Reading: