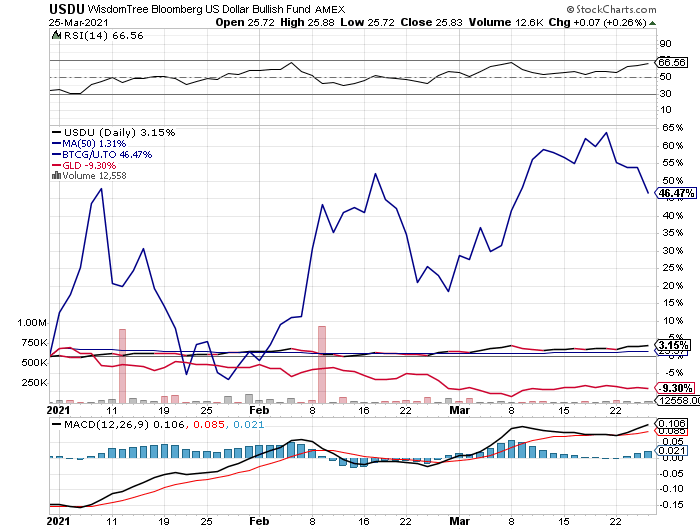

"It’s [Bitcoin] more a speculative asset. It’s essentially a substitute for gold, rather than for the dollar."

~ Jay Powell, Chairman, Federal Reserve

By Catherine Austin Fitts

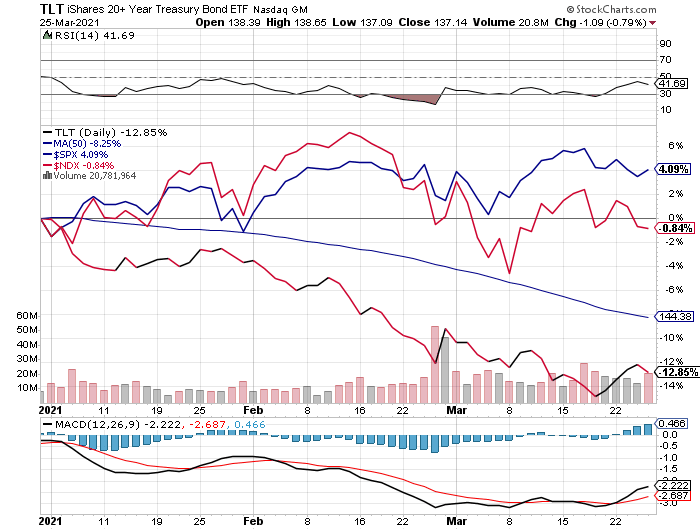

The central bank largesse of the Going Direct Reset made its mark across all markets throughout the 1st Quarter—bonds, equities, and precious metals. Two of the strongest prices have been those for large tech stocks and Bitcoin. Crypto systems continue to serve the Reset quite well. Having passed a trillion-dollar market capitalization, Bitcoin is drawing significant capital away from gold and silver, two traditional “smoke alarms” signaling monetary inflation. But signs of inflation are everywhere—so it is not surprising that interest rates have risen—and the long-term bond markets are signaling that we may finally be at the end of the great bond bull market. That means trillions are looking for real assets.

This Thursday, I will look at the effects of one year of lockdowns on the markets. I will also revisit the important issues to consider when you plan for an environment of rising risks.

Please join me for the 1st Quarter 2021 Wrap Up Equity Overview with the quarterly blockbuster from Rambus Chartology. Go to the web presentation on Thursday here to access the quarterly financial charts and Rambus Chartology.

In Let’s Go to the Movies, as we are approaching Easter, I recommend you check out Part 1 of Dr. Jordan Peterson’s presentation on The Psychological Significance of the Biblical Stories, which gives an introduction to the presence of God. If you’ve ever considered reading the Bible and never found the time or courage to do so, hearing Peterson think through this material, unscripted, is enlightening.

Biblical Series I: Introduction to the Idea of God.

You can find the entire series here.

Subscribers can e-mail or post questions and story suggestions for Money & Markets for this week and find current financial charts here.

Related Solari Reports:

1st Quarter 2020 Equity Overview

Related Reading:

1st Quarter 2021 Wrap Up: Equity Overview & Rambus Chartology – Additional Links