“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.”

— Alan Greenspan

By Catherine Austin Fitts

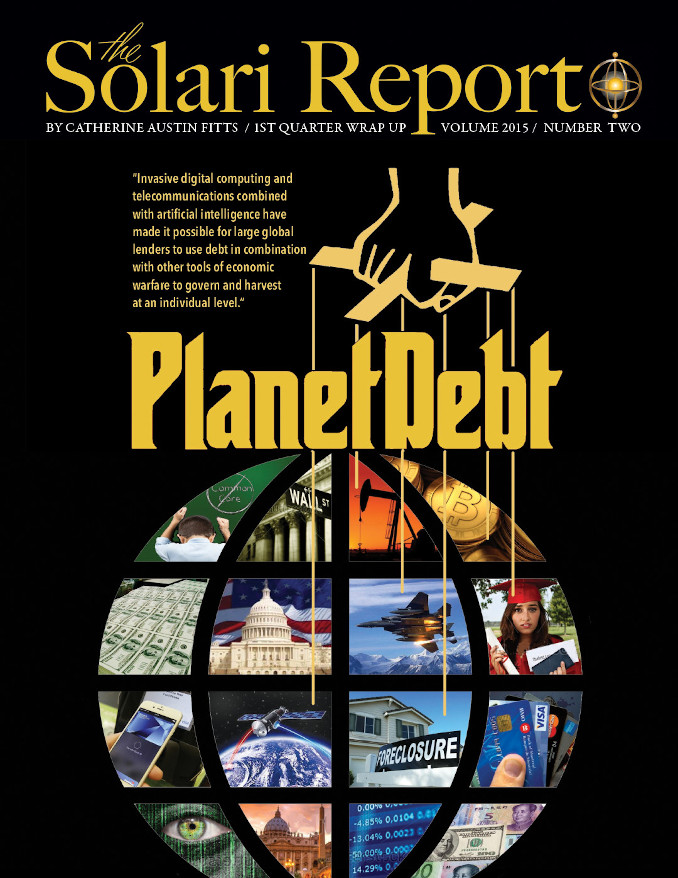

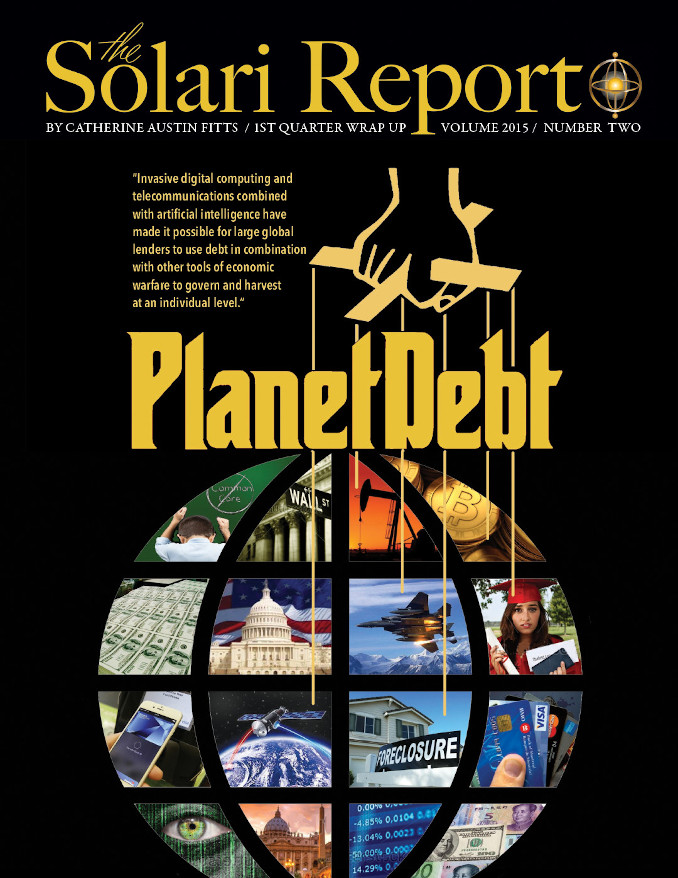

The dominant theme in our Annual Wrap up in January was Planet Equity. In our 1st Quarter Wrap Up, we explore a related part of the global balance sheet: Planet Debt.

The systematic harvesting of countries around the globe has been ongoing since WWII – whether by encouraging countries to issue debt, particularly dollar denominated debt, or to buy US debt. It is not surprising that some of the biggest buyers of US Treasury securities are nations that have had a US military presence since WWII. Nor is it surprising that there is a relationship between large military expenditures and high debt levels.

What has evolved on planet earth is the ultimate financial entrapment operation in which one set of players can:

- Create fiat money and lend at zero expense

- Maintain an information advantage that violates the laws related to material omissions in financial transactions, fraudulent inducement and predatory lending

- Engage in dirty tricks that impact the borrower’s ability to pay

- Legislate laws and regulations that make it profitable to lend to people who fail and cannot pay back their debt principal

On Thursday, April 23, the Solari Report team will publish our First Quarter Wrap Up, complete with a web presentation including graphs and charts designed to “pull back the curtain” on this important subject.

I will be covering:

- How global debt is an essential part of the central banking-warfare model

- Debt and the “Databeast”

- Global and domestic blowback resulting from debt

- Mandating markets for monopolists

- Q1 News stories and trends

- Q1 Financial markets

- Where it’s all going

Please join me on the Solari Report this week! Not a subscriber? Learn more here…