“Nominal GDP growth over the past five years would have been negative if U.S. public debt had not increased, one thing everybody seems to miss when they look at these GDP numbers … they seem to not understand that the growth in the GDP it looks pretty good on the screen is really based exclusively on debt—government debt, also corporate debt and even now some growth in mortgage debt.” ~ Jeffrey Gundlach

By Catherine Austin Fitts

This week is the 3rd Quarter 2019 Equity Overview with the quarterly blockbuster from Rambus Chartology. Check out the web presentation here for the quarterly financial charts and Rambus Chartology when posted on Thursday.

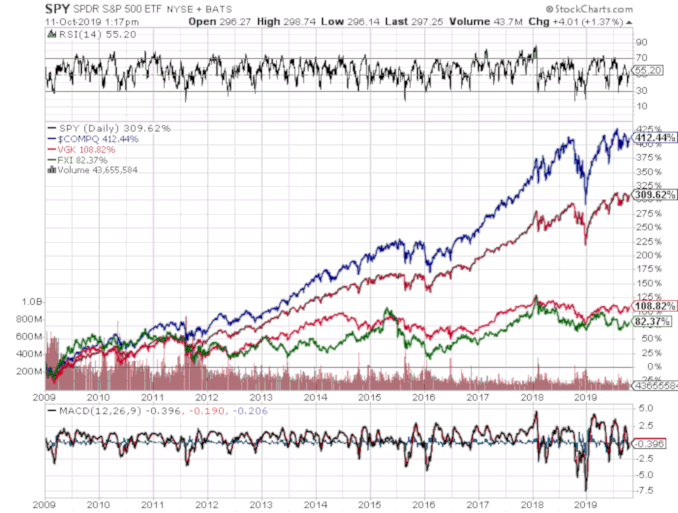

The U.S. equity market continues to outperform global equity markets. Here is a comparison of the NASDAQ and S&P with European and Chinese equity ETFs since 2009.

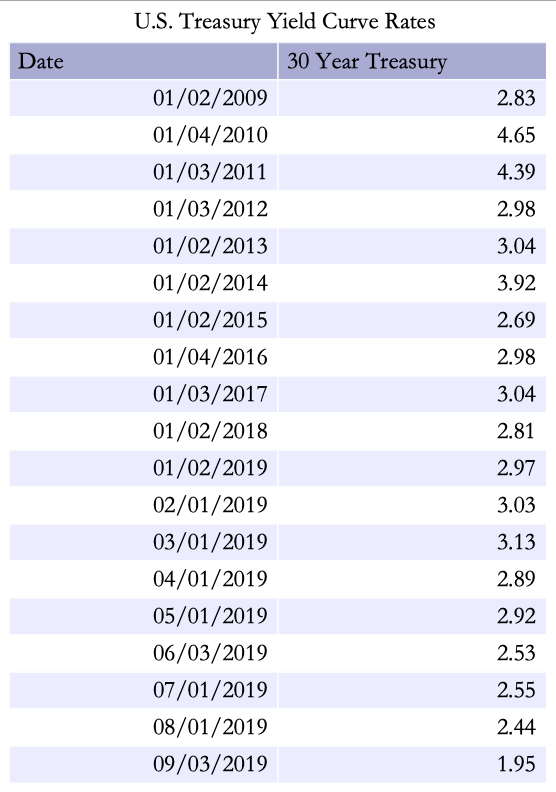

The Trump administration considers the U.S. stock market an essential performance indicator. The administration’s target appears to be a Dow above 30,000. Last quarter, I discussed what this means in terms of practical policies—from FASAB 56, to privatization and federal deregulation, to lower Fed interest rates that permit government and large corporations to carry high debt levels at a lower cost of capital.

Also discussed were trends that could pinch corporate profits, including increased chances of recession, explosive U.S. sovereign debt, the decline of the unipolar model, and the challenges of the U.S.-China trade war and changing global supply lines. And, oh yes, the effort to start World War III.

This quarter, I will focus on the storm clouds gathering for the large cap U.S. tech and health care companies that have contributed to the outperformance of U.S. stocks. The tech giants are the target of serious antitrust investigations by federal and state agencies. The global efforts to tax multinationals will increasingly limit jurisdictional flexibility. Large jury awards related to opioids and pesticides also indicate a growing willingness to enforce expensive accountability against irresponsible corporate behavior.

Is the ability of the U.S. political class to engineer outsized monopoly profits into its largest corporations coming to an end? Or, in the face of rising backlash against political corruption and inequality, are we simply witnessing a shift to secret revenues and assets engineered through the Fed, Treasury, and mortgage markets? I will also address the mother lode of all financial steroids—Secretary Mnuchin’s proposal for privatizing mortgage giants Fannie Mae and Freddie Mac—and its implications in combination with FASAB 56 and national security law.

In Let’s Go to the Movies this week, I will review In Search of Greatness, a documentary about athletic genius that has a lot to say about living a free and inspired life.

Please e-mail your questions for Ask Catherine or post them at the Money & Markets commentary here.

Talk to you Thursday!

Related Reading:

GMO 2nd-Quarter Letter: Bigger’s Been Better

2nd Quarter 2019 Wrap Up – Equity Overview & Rambus Chartology

1st Quarter 2019 Wrap Up – Equity Overview & Rambus Chartology

2018 Annual Wrap Up – Equity Overview & Rambus Chartology

Web Presentation

You can view financial charts at the web presentation here. The Rambus Blockbuster Chartology will be posted here on Thursday. Use your Solari password to login!